Nasdaq says SEC’s market structure proposal raises more questions than answers

The potential change to Nasdaq’s revenues due to the new rules could largely be dependent on the net impact of customers who decide to switch to a new consolidated SIP.

Nasdaq today published an IR update regarding the market structure proposal unveiled by the Securities and Exchange Commission (SEC) earlier in February.

SEC‘s market structure proposal is set to change equity trading under Reg NMS by re-defining which orders will be displayed in the market (under NMS Rule 604), how many shares will be required for orders to be “protected” from trade-throughs (under NMS Rule 611) and when markets can be locked or crossed (under NMS Rule 610).

Further, the proposed rule will shift regulation of brokers/dealers that handle investors’ orders by adding further ambiguity to the Duty of Best Execution owed to customers, and the calculations and disclosures of order handling (under NMS Rule 605 and Rule 606).

It also reforms regulation of exchanges by changing the operation of short selling regulation (under Reg SHO Rule 201), Limit Up/Limit Down and MarketWide Circuit Breakers, and creating new categories of “Regulatory” and “Administrative” data under NMS Rule 600.

The new rule also changes the collection, consolidation and dissemination of market data to investors, including what data is collected from brokers and exchanges, and how that data will be consolidated and distributed.

Importantly, the new rule expands the scope of consolidated “SIP” data to include five levels of depth-of-book data and exchange auction data, including changes to NMS Rules 600, 603, and 608.

It will also see the creation of a system of competing consolidators that would be authorized to buy and distribute all consolidated data from all exchanges. A competing consolidator would be required to make all consolidated data available to those that wished to purchase it.

The new rule allows “self-aggregators” to buy and consolidate data for their own use, subject to few regulatory standards, and establishes a new system of registration for a new class of market participants — “competing consolidators“ and subjects them to registration and to provisions of Regulation SCI.

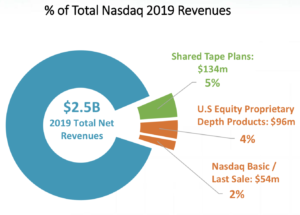

Nasdaq notes that the potential change to its revenues could largely be dependent on the net impact of customers who decide to switch to a new consolidated SIP, away from depth or Nasdaq Basic products. While product substitution could occur, Nasdaq would receive compensation from new content and potential additional users of core market data.

The SEC’s rulemaking proposal, if implemented as proposed, would require additional information before impacts can be reasonably assessed. Therefore, Nasdaq is not making changes at this time to its medium-term outlook of low to mid single digit revenue growth for market data.

The SEC’s rulemaking proposal, if implemented as proposed, would require additional information before impacts can be reasonably assessed. Therefore, Nasdaq is not making changes at this time to its medium-term outlook of low to mid single digit revenue growth for market data.

Nasdaq notes the proposal is complex, thus giving way to more questions than answers.

For instance, the proposal abandons the single, unified NBBO in favor of a decentralized, splintered NBBO calculated by dozens of different participants. Investors will have no “North Star” for determining the quality of their trades.

Nasdaq also stresses that the proposal partially rescinds the rule against locking or crossing the markets, allowing some orders to lock or cross the market depending on the price of the stock, the size of the order, and the state of the NBBO.

In addition, a bifurcated system of round lots and protected quotes would exist, with orders below 100 shares not being protected even though they are redefined as round lots and will be displayed in the exchange data feed. Therefore, displayed retail orders will not be protected against trade-throughs.

Nasdaq sees the SEC’s proposal as giving rise to numerous issues with respect to pricing and product design of market data. Thus, for example, according to Nasdaq, the proposal is silent on critical elements of market data products, pricing and production. Unknown are the products that will be offered, the prices of these products, the allocation of quote and trade revenue, the collection of revenue from newly-registered competing SIPs and self-aggregators.

Furthermore, Nasdaq says the proposed rule creates several conflicts of interest amongst clients and competitors, and a dramatic expansion of the role of government and interested parties in rate-setting within competitive industries.

Finally, multiple NBBOs will make it harder to surveil market activity to protect investors.

The SEC issued the proposed rule on February 14, 2020. After the proposed rule is published in the Federal Register, a 60-day comment period begins. After comment period closes, the SEC must review the comments, and this process can take several months to complete.