New version of cTrader Desktop platform adds a raft of new indicators

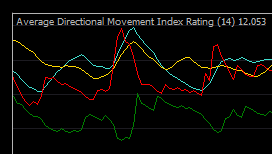

The list of new built-in indicators includes Hull Moving Average, Average Directional Movement Index Rating, Alligator, Supertrend, Cyber Cycle, Polynomial Regression Channels, Center Of Gravity, Fractals.

Fintech firm Spotware Systems today announces the release of cTrader Desktop 3.8. This version comprises highly-requested drawing features, such as the ability to lock, hide, duplicate using the “Ctrl” key and further customise drawings. Additionally, traders’ accounts can now be hidden, an additional language is available and eight more indicators have been added in the platform’s built-in indicators library.

The list of new built-in indicators includes: Hull Moving Average, Average Directional Movement Index Rating (ADXR), Alligator, Supertrend, Cyber Cycle, Polynomial Regression Channels, Center Of Gravity, and Fractals.

The list of new built-in indicators includes: Hull Moving Average, Average Directional Movement Index Rating (ADXR), Alligator, Supertrend, Cyber Cycle, Polynomial Regression Channels, Center Of Gravity, and Fractals.

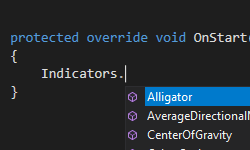

There are also changes in cTrader Automate API. New properties IsLocked and IsHidden are now available for all chart objects. Moreover, the following new properties for ChartText have been added: FontSize, IsBold , IsItalic, and IsUnderlined. There are also eight new built-in indicators available via API.

There are also changes in cTrader Automate API. New properties IsLocked and IsHidden are now available for all chart objects. Moreover, the following new properties for ChartText have been added: FontSize, IsBold , IsItalic, and IsUnderlined. There are also eight new built-in indicators available via API.

A new window has been added, allowing traders to manage drawings and indicators on a chart. Traders can search and see their drawings per symbol, while charts can also be scrolled to selected drawings.

Traders get the ability to lock drawings. Once a drawing is placed on the chart, its position can now be locked in order to prevent accidental mouse interactions. Also, any drawing can now be temporarily hidden using the Hide/Show toggle button in Object Manager. The “Hide All Drawings” button allows traders to quickly hide all drawings on the chart, in order to see a clear price picture or create a new drawing without any visual obstacles.

Accounts can be hidden using a new button. Hidden accounts will be placed in a “Hidden Accounts” sub menu, where they can still be used or made visible again.

Let’s recall that, in the preceding release of the platform a fully-integrated FXStreet Economic Calendar became available. Traders also got access to Multi-Symbol Backtesting for cTrader Automate.