New version of cTrader mobile app comes equipped with Dark Theme

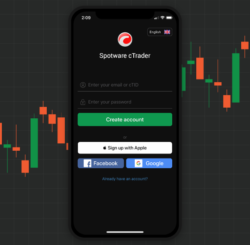

Version 3.12 of the app also offers a “Sign in with Apple” option for quick authentication.

Fintech expert Spotware Systems has just announced the release of a new version of its cTrader mobile app for iOS-based gadgets.

The new cTrader Mobile 3.12 release comes equipped with the much-requested Dark Theme on iOS, as well as with a “Sign in with Apple” option for quick authentication.

The highly sought-after dark interface, which reduces strain on the eyes and adds style to the cTrader platform, is now available on iOS.

In addition, for an even faster and more secure authentication, traders can now log in to the cTrader platform with their Apple ID.

In addition, for an even faster and more secure authentication, traders can now log in to the cTrader platform with their Apple ID.

The version also comprises iOS SDK 13 features’ support, and a series of bug fixes and performance improvements on both – iOS and Android devices.

The team of Spotware Systems has been regularly updating the cTrader mobile apps. The preceding version (3.11) of the cTrader Mobile app introduced three chart types – Tick charts, Range and Renko bars. This way, all cTrader desktop chart types are now available in the mobile app. Tick charts, Range and Renko bars allow mobile traders to get absolute trading experience with a full spectrum of chart types for advanced technical analysis and better forecasting of future market movements.

Also, the Fibonacci Retracement got equipped with extra moving precision of the edges. Additionally, the option to hide indicator titles allows for further space release for technical analysis purposes.