New version of cTrader Web adds Pencil Tool & Line Study extension

cTrader Web 3.4 offers more analytical flexibility thanks to the Pencil Tool and fresh extensions of the Line Study Tools.

Fintech expert Spotware Systems has earlier today unveiled a set of enhancements available in the latest version of cTrader Web.

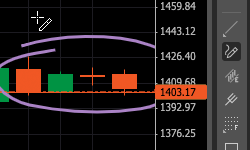

cTrader Web 3.4 adds Pencil Tool, which allows traders to draw shapes and objects of their choosing on charts in any chart mode by means of a pen cursor. Used to free-form draw on, or annotate a chart, the Pencil Tool is not bound to a specific shape like most other drawing tools, and allows one to make notes directly on the chart when setting up a trade, which proves useful for reviewal purposes.

cTrader Web 3.4 adds Pencil Tool, which allows traders to draw shapes and objects of their choosing on charts in any chart mode by means of a pen cursor. Used to free-form draw on, or annotate a chart, the Pencil Tool is not bound to a specific shape like most other drawing tools, and allows one to make notes directly on the chart when setting up a trade, which proves useful for reviewal purposes.

The platform introduces new Line Study Tools which offer traders extra convenience and a personalized aspect to the toolset. Among the provided options, new additions include: Color Picker with opacity settings and Line Thickness Selector.

New options can be accessed through the Line Study Toolbar or object settings, which are unfolded by means of a left-click on the object in question.

The Active Symbol Panel’s Trading Central window has seen the addition of Trading Central Targets. As of now, one can not only trade directly from the panel, switch intraday and short-term trading modes, open the chart and gain insights by unfolding the “See more”, but also use Targets for decision making.

Additionally, two new hotkeys have been added for further ease of operation:

- Ctrl + F – to switch between Watchlists and Finder;

- Ctrl + Drag – to duplicate an object.

There are also cTrader Copy 3.4 updates. These are tailored for intuitive platform operation.

The Details section of Copy Trading Account has been updated to include date and time of copying start. Thanks to this enhancement, users can easily track when performance and management fees will be charged.

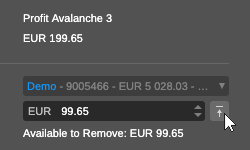

Let’s also note that the Add Funds dialog and Remove Funds dialog have been modified to include an Add/Remove All Funds option. This way, all available funds can now be added or removed with a click of a button, instead of manual number insertion, simplifying the procedure and saving user time.

Let’s also note that the Add Funds dialog and Remove Funds dialog have been modified to include an Add/Remove All Funds option. This way, all available funds can now be added or removed with a click of a button, instead of manual number insertion, simplifying the procedure and saving user time.

Earlier this month, an updated version of the cTrader mobile app was released. Stop Loss and Take Profit can now be added to positions & orders, and pending orders can be amended by drag & drop directly on the chart. Further, the Trend Line and Ray are improved, with precise moving of the edges. In addition, charts can now be scrolled to the future, for technical analysis purposes.