New version of OANDA fxTrade mobile app enables partial closing of trades

The latest version of the solution allows traders to partially close any of their open trades.

Online trading services provider OANDA has rolled out a new version of the OANDA fxTrade mobile app.

The new version of the solution adds a “partial close” functionality. That is, traders can now partially close any of their open trades. To do that, they have to tap the reduce button on any open trade and specify how many units to partially close it by.

Let’s note that U.S. customers must still follow the FIFO rules. First in First Out (FIFO) is an FX trading requirement that complies with the United States National Futures Association (NFA) regulation. It is a requirement that the first (or oldest) trade must be closed first if a customer has more than one open trade of the same pair and size.

In the summer of 2019, OANDA implemented changes concerning FIFO that require all trades that have a take profit (TP), stop loss (SL), or trailing stop (TS) to be of unique size. The only scenario in which two trades of the same currency pair can be the same size is if neither trade has a TP, SL, or TS. These changes only impact customers who contract accounts from OANDA Corporation.

The company has been regularly updating and enhancing its mobile solutions. In one of the recent releases, the calendar was improved, as the app added a 3-day schedule that allows traders to see when markets are open or closed.

The app version released in April enabled search for instruments in the rates list. It also included organization of instruments by type, making it easier to find the favorite pairs and add them to one’s favorites list.

The version of the solution rolled out in February contained a few small changes to the rates screen, including allowing traders to see what markets are closed (greyed out with a clock icon).

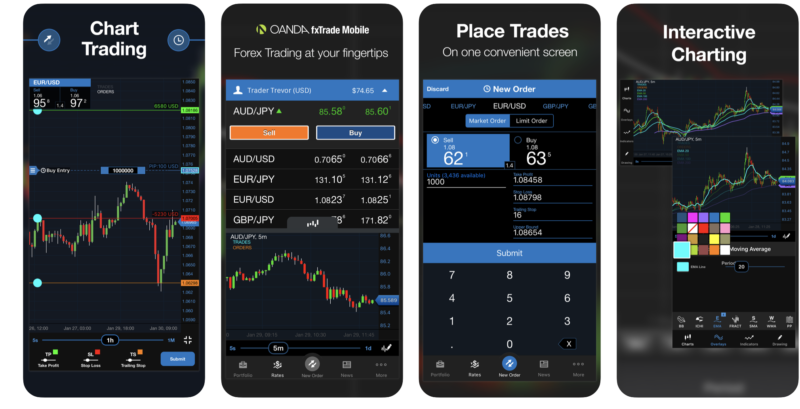

The OANDA fxTrade app offers traders access to live, real-time prices to trade major, minor and exotic instruments on the world’s top financial CFD, forex, and precious metals markets. Users can trade flexible lot sizes with competitive spreads supporting multiple sub-accounts.

Users of the app can trade faster and easier from a single view placing orders directly on the chart.

The solution also offers more than 50 technical tools, including 32 overlay indicators, 11 drawing tools, and 9 charts to easily edit your take profit, stop loss and trailing stop orders.

Traders can manage positions, control risk, and monitor account profitability in one touch to react to market activity in real-time wherever they are. The users of the app can also benefit from automated custom notifications on price alerts, order expiry, upcoming economic calendar events, and global market news from leading providers.