New Zealand FX trader changes plea to “guilty” in fraud case

Kelvin Clive Wood pleaded guilty today to charges of ‘Obtaining by deception’ and ‘Theft by person in a special relationship’.

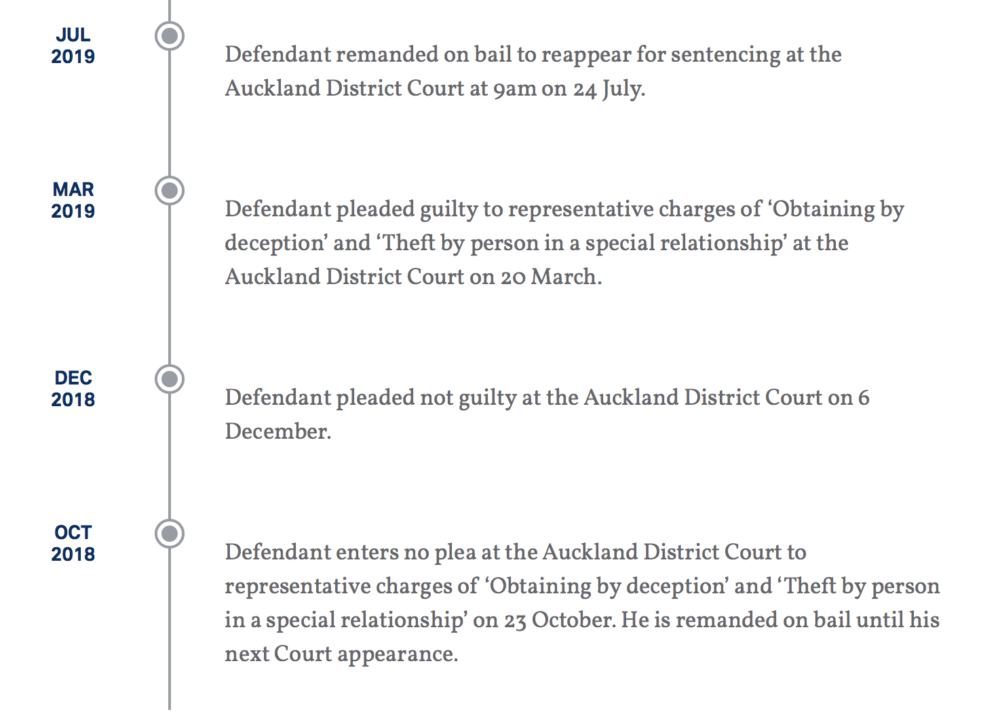

Several months after Kelvin Clive Wood pleaded “not guilty” to running a Ponzi scheme, the Forex trader has changed his plea. New Zealand’s Serious Fraud Office (SFO) today announces that the defendant pleaded guilty to running a Ponzi scheme to defraud his clients of more than $7 million.

Wood pleaded guilty today at the Auckland District Court to representative charges of ‘Obtaining by deception’ and ‘Theft by person in a special relationship’ brought by the Serious Fraud Office.

The Auckland man orchestrated a Ponzi scheme after his FX brokerage started to incur net trading losses. He used new investors’ funds to pay other investors their reported gains or to refund investment principal. Wood’s clients were not aware that their funds were being used to repay other investors.

Wood is alleged to have facilitated foreign exchange and trading services through two companies – Forex (NZ) Limited and Forex NZ 2000 Limited. His clients placed money with him through his companies for the purpose of fixed interest term deposits, the purchase of foreign currency, general investment and foreign exchange trading purposes. Clients invested on the basis that their principal was not at risk.

According to the SFO allegations, the defendant operated his Ponzi scheme from January 2010 to May 2017 – using new investors’ funds to pay other investors their reported gains, or to refund their principal investment. The SFO estimates that 18 investors lost at least $7 million as a result of the defendant’s offending.

The defendant knowingly reported fictitious profits and false or inaccurate foreign currency trades to investors.

The Director of the Serious Fraud Office Julie Read said, “Mr Wood earned the trust of a group of investors through his personal and professional association with them. He misappropriated their funds and falsely reported trading profits so they would not seek to withdraw their funds. The SFO will prosecute all serious fraud matters brought to our attention to protect other investors and New Zealand’s reputation as a corruption-free market.”

The defendant has been remanded on bail to reappear for sentencing at the Auckland District Court on July 24, 2019.

The Financial Markets Authority (FMA) referred the case to the SFO to investigate in May 2017.