Newest version of NinjaTrader introduces FX Correlation window

Version 8.0.19.0 of the platform, which also offers Order Flow VWAP and Order Flow Volumetric enhancements, is now available for download.

NinjaTrader, a specialist in trade simulation, advanced charting, market analytics and backtesting, has released a new version of the platform, which, inter alia, adds an FX Correlation window.

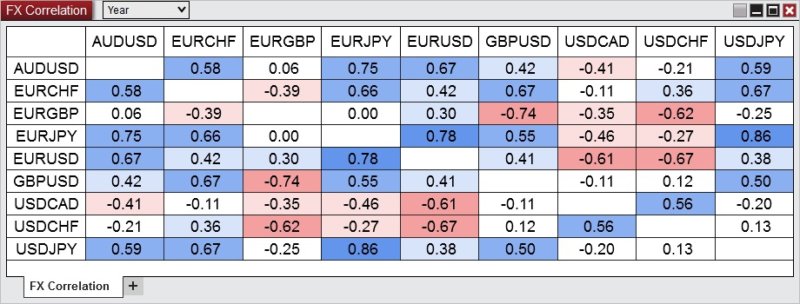

The FX Correlation window is used to display a correlation between multiple Forex instruments. Values close to 1 indicate movement in the same direction. Values close to -1 indicate movement in opposite directions. Values near 0 indicate no correlation.

The latest version of the platform also includes Order Flow VWAP enhancements. Multiple features have been introduced to further increase customization on functionality. A Reset interval can now be set to Sessions, Weeks, or Months. Each standard deviation can now have color and opacity individually set.

Further, Order Flow Volumetric enhancements have been introduced. Multiple features have been added to further increase customization and functionality. For example, the candlestick can now be centered on plot. Also, a Size filter property has been added to only include values greater than the threshold.

The bar statistics now feature Delta SL & Delta SH to measure how long since the delta touched the high/low of the bar.

Finally, the newest version of the platform sees options support added. This can be accessed with the new Option Chain window for users utilizing NinjaTrader Continuum connection and have enabled ‘Web API’. Linking with order entry windows and selecting a bid or ask quote within the option window will load the option into the order entry window for order placement.

The preceding version of the platform (Version 8.0.18.0) added an Automatic Strategy Generator – a NinjaTrader experimental feature that may or may not evolve over time. Traders are set to be able to automatically generate a NinjaScript strategy with the new experimental “AI Generate” backtest type. One can configure any number of indicators and/or candle stick patterns to be considered and sit back while NinjaTrader does all the work. After running the AI Generate it will list the best strategies from the results. Selecting View will then pull up the strategy code in the NinjaScript Editor so that a user can view it and save it if desired.