Nordnet hires digital employee Amelia to let “humans focus on what humans do”

While Amelia responds to customer queries 24/7, her colleagues are poised to be able to dedicate more time to other activities.

FinanceFeeds has been keeping its readers informed about the latest advancements in financial technologies, and the increased adoption of artificial intelligence solutions by banks and other financial services firms has been a key trend over the past year.

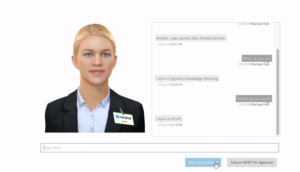

One more piece of news in this respect comes from digital Nordic bank Nordnet which has enrolled its first digital employee – Amelia, who will work side by side with her human colleagues in the customer relations department. Amelia has been developed by IPsoft, and is about to start working at Nordnet this fall.

Her first role will be to support new customers through the onboarding process and help them with tasks such as account activation. One of the advantages of Amelia is that she is available 24 hours a day, so that customers will be able to make use of the bank’s services whenever they see fit.

Commenting on the addition of Amelia to the bank’s team, Nordnet’s CEO Peter Dahlgren stressed that it is AI that is capable of meeting the individual needs of each customer and this has been the primary reason for investing in the adoption of Amelia. Furthermore, he noted, Amelia’s colleagues will be able to dedicate more time to activities that have more value. As a result, “humans can focus on what humans do”, he said.

The comments of Nordnet’s CEO echo those made by Albert’s Chief Marketing Officer Amy Inlow, who, in an interview with FinanceFeeds, explained that AI systems do not serve to replace human beings, they rather augment the work human employees are doing. “We believe AI marketing systems will empower marketers to do more higher value problem solving, and will not replace them”, she said.

In many financial companies, however, robots are actually replacing human staff in certain roles. Sberbank Rossii PAO (MCX:SBER), for instance, is about to reduce the size of its back-office workforce 12 times by 2021. Currently, the bank has 12,000 back office employees, with the number to be axed to 5,000 by 2018 and to 1,000 by 2021.

Furthermore, major Forex dealers are increasingly seeking to replace human traders with AI systems. JPMorgan, which is at present the largest FX dealer by global volume, has commenced the development of an AI solution which will execute trades in place of human traders.

The implementation will now proceed, following a trial which demonstrated that AI is more efficient than traditional methods of buying and selling. The robot will be rolled out across Asia and the United States in the latter part of this year.