Number of approved Australian financial services licensees drops for first time, ASIC says

For the first year since inception, the total number of approved AFS licensees has fallen (from 6,170 in June 2018 to 6,159 in June 2019).

The Australian Securities & Investments Commission (ASIC) has earlier today published its Overview of licensing and professional registration applications for the year from July 2018 to June 2019. The report outlines ASIC’s decisions on applications for the relevant period.

The document shows that, for the first year since inception, the total number of approved AFS licensees has fallen (from 6,170 in June 2018 to 6,159 in June 2019). Given the generally consistent number of new AFS licences approved each year, ASIC explains that the decrease reflects an increase in the number of cancellations. However, the total number of AFS licensees is still significantly higher than at the commencement of the regime.

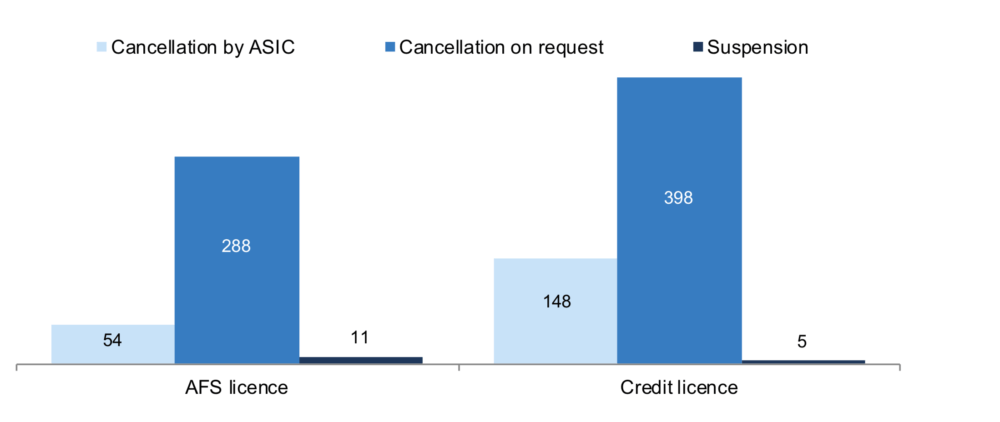

In the relevant period, ASIC cancelled 342 AFS licences and suspended 11 AFS licences.

In 2018–19, the Australian regulator refused nine AFS licence applications. A total of 172 AFS licence applications and 154 credit licence applications were voluntarily withdrawn before ASIC made a formal determination. For both AFS licences and credit licences, the regulator believes the number of applications refused would have been much higher if applicants had not withdrawn their applications in response to ASIC’s feedback.

The regulator reminds the licensees that, on 1 November 2018, the law was changed to replace the two existing ASIC-approved external dispute resolution schemes—the Financial Ombudsman Scheme (FOS) and the Credit and Investments Ombudsman (CIO)—and the statutory Superannuation Complaints Tribunal (SCT) with AFCA. All financial firms that are required to be members of an external dispute resolution scheme to deal with complaints from consumers and small businesses must now be members of AFCA. This includes trustees of regulated superannuation funds.

ASIC stresses it will not finalise a new licence application unless the applicant is a member of AFCA. ASIC can take action to suspend or cancel a licence if a licensee is not a member of AFCA.

During the relevant period, ASIC cancelled or suspended four AFS licences and 48 credit licences for a failure to obtain membership of the AFCA scheme.

The Australian regulator also stresses the importance of the new requirements for certain applicants, including FX companies. These entities will have to submit:

- C5: Foreign Exchange Operating Statement

- B3: Arrangements for Managing Conflicts of Interests

- B3: Compliance Arrangements

- B7: Risk Management System Statement.