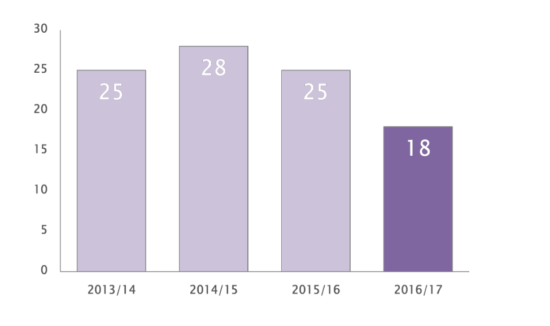

Number of FCA prohibition orders hits lowest level since financial crisis – RPC data show

The FCA banned 18 people from the financial services industry in the year to September 30, 2017, a post-crisis low, says professional services firm RPC.

The UK Financial Conduct Authority (FCA) banned 18 people from the financial services industry in the year to September 30, 2017, data from City-headquartered professional services firm RPC show.

The number of bans for 2016/2017 is down from the 25 people who received so-called ‘Prohibition Orders’ from the UK regulator in 2015/16. Prohibition Orders peaked at more than 70 per year during the financial crisis and its immediate aftermath, RPC notes.

According to the firm, the fall in the number of bans should not be interpreted as the FCA going soft on enforcement. “Rather it is the result of a significant toughening of the regulator’s approach to misconduct since the financial crisis”, RPC argues in its report.

Richard Burger, Partner at RPC, explains that the FCA’s approach of punishing individuals rather than institutions – dubbed “Constructive Deterrence” – appears to be paying off through a change behavior in financial services.

This approach will be extended in 2018, as less-senior financial services workers will be brought into the scope of the FCA’s Senior Managers and Certification Regime (SMCR). This regime makes individuals responsible for failings in the conduct and competence within financial services firms, and includes substantial fines and other penalties. It has thus far only applied to senior leaders in larger financial services businesses.

Richard Burger comments:

“The new SMCR will put many more individuals working in Financial Services onto the FCA’s radar. The FCA’s ‘constructive deterrence’ business plan relies on holding virtually everyone, not just senior managers, to account. SMCR and its conduct rules will cover most financial services staff in some way.”

“We may well see more behavioural change next year as the Senior Managers Regime is extended to almost the entire sector”, he says.

Earlier this year, data from RPC have shown that the FCA conducted seven dawn raids of business and individual’s premises in 2016. Dawn raids are searches under warrant and in the presence of a police officer. Their name reflects the fact that they are often conducted in the early hours of the morning in order to get a maximum amount of evidence. The raids are often accompanied by arrests.

RPC estimates show that the number of dawn raids conducted by the UK regulator last year marks an 81% drop from the 37 dawn raids that were carried in 2009 when the financial crisis was at its height. In fact, the law firm explains that the small number of raids that took place in 2016 reflects the gradual winding down of the regulatory clampdown on financial crisis era crime.