Number of investment cases opened by Canadian Ombudsman rises in Q1 FY19

Investment cases opened increased above the eight-quarter average, from 87 to 97.

Canada’s Ombudsman for Banking Services and Investments (OBSI) today announces some key metrics about its work during the period from November 1, 2018 to January 31, 2019.

In the first quarter of FY 2019, OBSI saw a decrease in cases opened from the eight-quarter average of 179 to 152, representing a 20% decrease. The sharp fall in total and bank cases opened is due to the departure of the Bank of Nova Scotia (BNS) and its subsidiary Tangerine at the end of the 2018 fiscal year.

The number of investment cases opened, however, increased above the eight-quarter average, from 87 opened cases to 97.

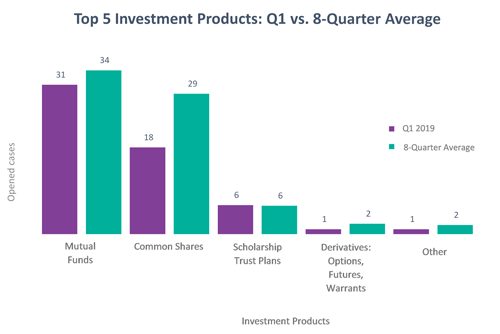

The first quarter saw common shares complaints fall to 18, representing a 38% decrease below the eight-quarter average. Apart from common shares, investment products complaints varied only slightly from the average over the past eight quarters.

Suitability remained the most frequently complained about investment issue in the quarter to end-January 2019, even though such complaints dropped to 17 compared to the eight-quarter average of 21. The number of incomplete/inaccurate disclosure complaints also fell, decreasing from an average of 8 complaints over the past eight quarters to 3 complaints in the three months to January 31, 2019..

Let’s recall that, in FY 2018, OBSI registered a 5% increase in cases opened, from 721 in 2017 to 760 in 2018. Investment complaints decreased from 351 cases opened in 2017 to 345 in 2018. Banking cases opened continued a multi-year trend, increasing from 370 in 2017 to 415 in 2018, up 12% year over year.

Compared to 2017, there were decreases reported in the top investment issues in 2018 in all categories except incomplete/inaccurate disclosure, which rose 17%. Cases related to suitability of margin or leverage decreased 39% compared to 2017.

Canadian investors are still targeted by binary options fraudsters in the face of the ban on the offering and marketing of these products. In a Bulletin published in August 2018, OBSI warned that binary options present a systemic risk.

OBSI said back then it had received numerous complaints from investors who used their credit card to purchase binary options. These investors later disputed credit card charges related to these transactions. They believed that because they did not receive the promised services (such as the ability to withdraw their investment capital) that the issuing credit card company should allow a chargeback or reversal of the charge. The Ombudsman found that the banks involved were not at fault for the failure of the chargeback request because they followed the normal chargeback policies and procedures.