OANDA enhances news feeds, adds new Price Signal feature to Android mobile app

v20 users can now turn any Vector or Horizontal Line drawing tools into a Price Signal, which triggers a push notification when the market crosses that line.

OANDA keeps updating its mobile trading solutions – the latest set of enhancements concerns the OANDA fxTrade mobile application for Android devices.

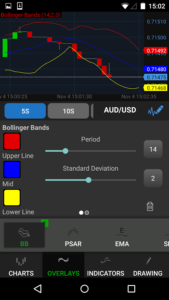

The improvements, introduced on Monday, cover some technical indicators (like CCI) that will see more configurable parameters, as well as the news feeds, where date headers have been added.

More interestingly, OANDA has recently launched a new feature called Price Signal on its mobile apps for its v20 clients. FinanceFeeds has noted the launch of this feature on the app for iOS devices. It is now also available on Android devices. The Price Signal feature is a replacement of OANDA’s old Price Alert feature available on Legacy accounts.

More interestingly, OANDA has recently launched a new feature called Price Signal on its mobile apps for its v20 clients. FinanceFeeds has noted the launch of this feature on the app for iOS devices. It is now also available on Android devices. The Price Signal feature is a replacement of OANDA’s old Price Alert feature available on Legacy accounts.

The novelty comes in response to client requests. v20 users can now turn any Vector or Horizontal Line drawing tools into a Price Signal, which triggers a push notification when the market crosses that line.

The Signal toggle can be found in the drawing tool configuration bar visible when the tool is selected.

The company notes that there is a limit to how many active signals users can have. Signals also expire after an extended period of time.

This is not the first time that OANDA introduces v20-related enhancements to its mobile apps. In May this year, the mobile application for Android devices made all Trade Default types available on v20 accounts, as well as on older accounts.

While we are on the topic of V20, we cannot skip mentioning the latest version of the MultiCharts platform, which introduces OANDA V20 REST API support. The OANDA v20 REST API provides programmatic access to OANDA’s next generation v20 trading engine. Anyone with a V20 trading account may use this API. The Trading Interface is selected in OANDA data feed settings in MultiCharts’ tool for database management QuoteManager. It is global and affects the data feed and all existing OANDA broker profiles.