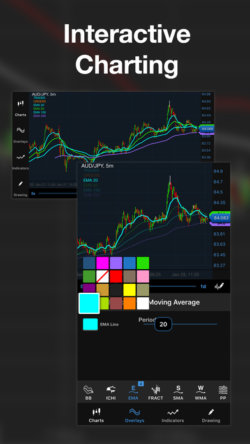

OANDA introduces more chart trading enhancements to fxTrade mobile app

Owners of iOS-powered devices may see additional information about their trades on the chart.

OANDA added chart trading to the functionalities of its fxTrade application for iOS-based mobile devices in February this year and has ever since enhanced the chart trading experience on mobile gadgets through several updates, including one rolled out in late March.

The latest version (5.4.2) of OANDA’s fxTrade mobile application for iOS devices was released on Thursday, and it also focuses on improving the trading experience, and chart trading, in particular.

Traders can now obtain additional information about their trades from the chart. More precisely, they can see their trade’s PL on the chart (at the top of the mobile device screen).

Users of the updated app can also close trades directly from the chart by tapping the ‘X’. Traders will be prompted to confirm even if confirmations are disabled. This minimizes chances of random actions and closing trades by mistake.

Users of the updated app can also close trades directly from the chart by tapping the ‘X’. Traders will be prompted to confirm even if confirmations are disabled. This minimizes chances of random actions and closing trades by mistake.

For that matter, let’s note that traders will be prompted to confirm when reducing or reversing a position.

Many of these improvements to the trading experience, including the additional information about a trade being available on the chart, were introduced on OANDA’s fxTrade mobile app for Android devices in April this year.

What these enhancements indicate is apparently a focus on allowing traders to obtain as much information and to perform as many operations as possible from one single place, without having to leave the active window or the platform.

Another important aspect of OANDA’s mobile application development is the push towards getting users’ feedback on existing and new functionalities, as well as making the process of submitting this feedback easier. iPhone owners can use the Feedback button on the More tab to do this, whereas owners of Android-based phones and tablets can use the Feedback button in the More tab and in the Accounts panel, respectively.

Another good option to examine the new functionalities currently developed by OANDA’s team is to visit OANDA Prototypes. The website enables users to view the new features of OANDA’s fxTrade platform and mobile apps and to leave comments about these. Whereas the new website is dedicated mostly to getting users’ opinion on particular features, the Feedback functionalities on the mobile apps permit sharing of ideas and, hence, proposing of new features too.