OANDA prepares for FIFO changes implementation

Changes will be implemented that will require all trades that have a take profit, stop loss, or trailing stop to be of unique size.

Online trading services provider OANDA is getting ready for FIFO changes, as indicated by an announcement on the company’s website and the release of a new version of OANDA’s mobile app to support the changes that will impact the clients of the brokerage in the United States.

First in First Out (FIFO) is an FX trading requirement that complies with the United States National Futures Association (NFA) regulation. It is a requirement that the first (or oldest) trade must be closed first if a customer has more than one open trade of the same pair and size.

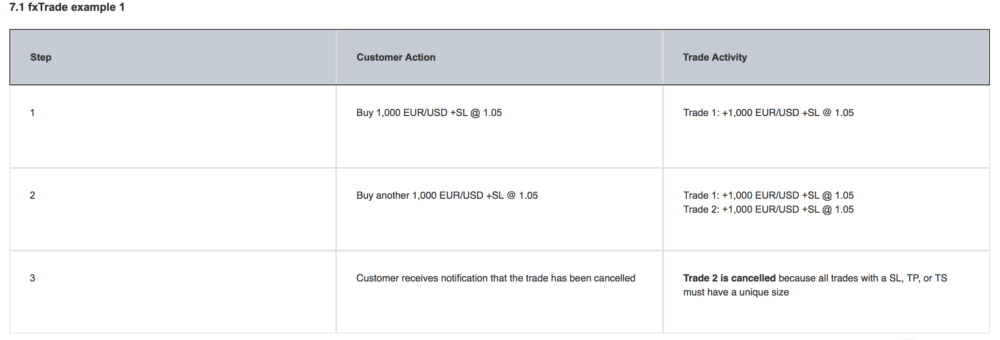

OANDA says changes will be implemented that will require all trades that have a take profit (TP), stop loss (SL), or trailing stop (TS) to be of unique size. After these changes are implemented, the only scenario in which two trades of the same currency pair can be the same size is if neither trade has a TP, SL, or TS.

These changes will only impact customers who contract accounts from OANDA Corporation. The FIFO changes are planned to come into effect by August 16, 2019.

After OANDA’s FIFO changes come into effect, any new trades entered on OANDA’s fxTrade platforms which do not comply with the FIFO requirement will be prompted with a warning prior to execution that the SL, TP or TS may cause a FIFO violation.

Limit/stop and entry orders are checked for FIFO compliance during trigger of their conditional price rather than during the order entry. If a limit/stop or entry order triggers and violates OANDA’s FIFO requirement, then the order is cancelled.

Customers will be able to check if their order was cancelled due to a FIFO violation under their activity history on fxTrade or in their mailbox on the MT4 platform.

MT4 will have the same restrictions as OANDA’s proprietary fxTrade platform. However, OANDA is unable to inform customers of these cancellations when they are running expert advisors (EAs), although they will still receive a message in their MT4 Mailbox.