OANDA rolls out new version of mobile trading app

Users of the solution will find it easier to get know when their favorite instrument will be online again.

Online trading services provider OANDA Corporation has just released a new version of the OANDA fxTrade Forex Trading mobile app for iOS-based devices, with the update focused on calendar.

In the latest version (5.6.3) of the app, users of the solution will find it easier to get know when their favorite instrument will be online again. Now the app offers a 3-day schedule that allows traders to see when markets are open or closed.

The app version released in April enabled search for instruments in the rates list. It also included organization of instruments by type, making it easier to find the favorite pairs and add them to one’s favorites list.

The version of the solution rolled out in February contained a few small changes to the rates screen, including allowing traders to see what markets are closed (greyed out with a clock icon).

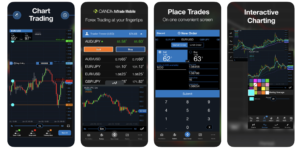

The OANDA fxTrade app for iOS gadgets offers traders access to live, real-time prices to trade major, minor and exotic instruments on the world’s top financial CFD, forex, and precious metals markets. Users can trade flexible lot sizes with competitive spreads supporting multiple sub-accounts.

Users of the app can trade faster and easier from a single view placing orders directly on the chart.

The solution also offers more than 50 technical tools, including 32 overlay indicators, 11 drawing tools, and 9 charts to easily edit your take profit, stop loss and trailing stop orders.

Traders can manage positions, control risk, and monitor account profitability in one touch to react to market activity in real-time wherever they are. The users of the app can also benefit from automated custom notifications on price alerts, order expiry, upcoming economic calendar events, and global market news from leading providers.