OANDA strengthens partnership with fintech firm Chasing Returns

Under the new agreement, OANDA clients will also be able to access more advanced Chasing Returns features across the firm’s entire suite of platforms.

Provider of online trading services, currency data and analytics OANDA today announces strengthening of its partnership with Dublin-based fintech firm Chasing Returns.

Thanks to the expanded collaboration, OANDA will offer clients around the world an extended suite of capabilities that utilise behavioural science research to help improve trading performance. The agreement further builds on the 2018 integration of Chasing Returns’ risk management technology into OANDA’s trading platform, which provided retail clients with access to the Trading Performance Management portal.

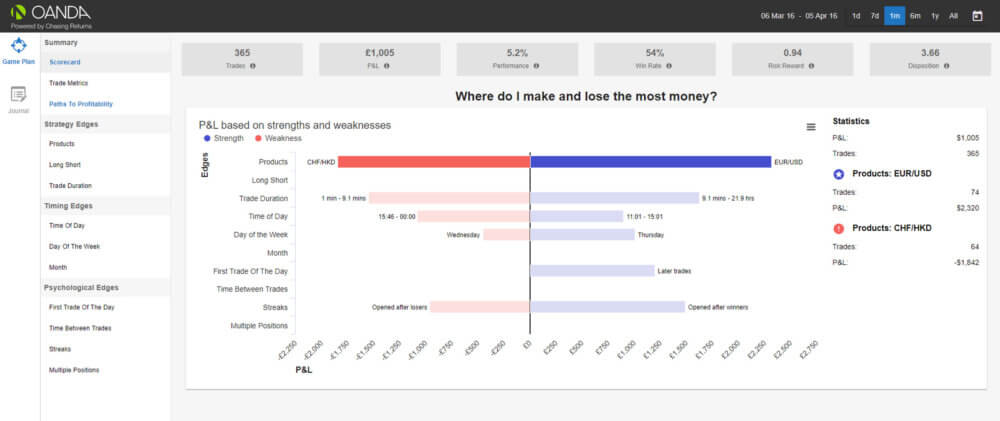

Harnessing Chasing Returns’ specialist understanding of behavioural science, the Trading Performance Management portal already provides an in-depth view into individual trading habits, enabling OANDA’s clients to take immediate advantage of personal analytics to better understand their behavioural biases such as whether they are more successful on a particular day of the week or when trading a specific product.

Now, under the new agreement, OANDA clients will also be able to access more advanced Chasing Returns features across the firm’s entire suite of platforms – including the API and third-party platforms – such as:

- Gameplan Pro, which includes enhanced trading insights focusing on the psychological aspect of the individual trader’s performance;

- A new goal-setting option that allows traders to set predefined targets to achieve their trading goals;

- PlayMaker, which enables traders to monitor risk in real-time and set predefined take profit and stop-loss levels;

- OANDA Performance Statements option that allows traders to keep daily records and download statements on demand that include Chasing Returns performance data and market insights alongside their account history.

“A FinTech firm at heart, OANDA has long been dedicated to providing clients with access to state-of-the-art trading tools that utilise cutting-edge technology to help them be more successful. As such, extending our ongoing relationship with Chasing Returns was an obvious choice, introducing new features and advanced functionality to our OANDA Trading Management Portal that clearly add value to clients by showing how a better understanding of inherent individual trading biases can lead to improved discipline and portfolio profitability,” said Mohsin Siddiqui, Chief Client Officer at OANDA.