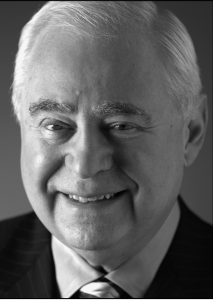

Obituary: Electronic trading pioneer Les Rosenthal. 66 years of leadership

NFA Founder and electronic trading pioneer Leslie Rosenthal has passed on at age 84, leaving a legacy as a man who established so much of the landscape of our industry. “It’s changed somewhat now that so much of the trading is happening on the screen. In the electronic marketplace, you don’t see the people eye to eye and you don’t know who you’re making your trade with, but integrity is still very important” he said recently, reminiscing on his illustrious career

“Unless you do something to change with the times, you become non-existent” – Leslie Rosenthal

A very often overlooked matter is that, rather than being a direct rival to the more modern and recently flourishing OTC derivatives sector, electronic platforms that provide trading via a centralized counterparty formed the roots for today’s retail trading topography.

Some of the largest and most prominent OTC FX companies that have become large, and in some cases publicly listed household names with a reputation that stands them out as a bastion of advancement and sophistication, and whose leaders are renowned for their detailed knowledge that combines technology with a comprehensive understanding of the functionality of global financial markets have their roots in the institutional, interbank and exchange traded futures sector in the world’s largest financial centers.

Thirty years ago, the OTC derivatives business made its split from the traditional exchanges, and the electronic trading business went two ways: That of London, and that of Chicago.

Just two days ago, on September 16 this year, one of the pioneers of global electronic trading departed.

Leslie Rosenthal began his career on the trading floor at the Chicago Board of Trade (CBoT), and during his illustrious and forward-thinking career spanning some sixty one years, rose to hold senior positions at the National Futures Association (NFA), a directorship of CME Group, one of the world’s largest and most diversified derivatives marketplaces, among other senior positions among Chicago’s futures giants.

Mr. Rosenthal was actually one of the NFA’s founders, which at the time was established as a futures industry self-regulatory body that administered licensing examinations and registration for futures and options brokers, trading advisers, and firms as well as provided arbitration services. Today, it is regarded as the most well organized, transparent and powerful non-bank financial markets regulatory authority in the world.

In 1981 and 1982, Mr Rosenthal was elected to two one-year terms as chairman of the Chicago Board of Trade. During his terms of office, he created new classes of membership for the CBOT to allow trading opportunities to develop. He was also responsible for enabling the innovation and growth of financial futures. In 1988, when J. Robert Collins merged his own firm with Rosenthal & Company, the firm name changed to Rosenthal Collins Group.

According to the FIA, which used to stand for Futures Industry Association and now is known as FIA, an organization that refers to itself as the leading global trade organization for the futures, options and centrally cleared derivatives market, “Of all the brokerage firms that have sought to move the Chicago exchanges, few have had the influence of the Rosenthal Collins Group. Everyone who trades Treasury futures today owes Les Rosenthal a debt of gratitude, because he provided the essential leadership necessary to win the members’ approval to develop and launch the Ginnie Mae futures contract, the world’s first contract based on interest rates.”

Mr Rosenthal recently reminisced on his initial days at CBoT, as well as looking through his career there, stating “Integrity is a very integral part of the system here at the CBOT.”

“It’s changed somewhat now that so much of the trading is happening on the screen. In the electronic marketplace, you don’t see the people eye to eye and you don’t know who you’re making your trade with, but integrity is still very important. But in the days that we’re talking about, integrity was very important, because you made a trade with a person across the pit, and sometimes it wasn’t anything more than a gesture” Leslie Rosenthal

You would nod your head or you’d flick your finger or you would do other acknowledging things. You’d have to make sure that the person that you were making that trade with showed up the next day, even when the trade might be against him, because if he didn’t, then you would be out of luck. There were very few instances that I can recall of anybody not showing up. Once in a while it happened, but most of the time the man who made the trade was as good as his word” said Mr Rosenthal.

Mr Rosenthal graduated from Roosevelt University with a degree in history, and said that he simply “needed a job.”

He once explained that being a ‘runner’ was the only job he could find that would fit any program that was available to him during the early days of his career, and that at the time he didn’t have any prior knowledge. Excited by the future possibilities, Mr Rosenthal did not simply follow commands and consider it a mere ‘job’, but continually sought methods of looking to advance the entire structure of the business, thinking constantly about how to do so as a young man taking orders from the telephone station down to the pits.

Borrowing $5000 from his father in law shortly after graduating from college and finishing his compulsory army service, Mr Rosenthal bought a membership of the CBoT, which he was able to repay quite quickly, and had joined at exactly the right time that suited his avantgarde plans for leadership.

The exchange was in the process of an evolution. “We were going from the normal type of things that had gone on there for the 50 years before that. So there were some real characters down there. There were many different types of traders on the floor” said Mr Rosenthal looking back.

“For example, there was a family down there named Griffin. Bill Griffin was a big trader. There was a fellow named Joe Dimon who was a real character. There was a man named Vince Fagan. There were a number of people on the way out at the time. One of the biggest traders was Dan Rice. He was still active, but not as active as he used to be. So, what we had down there was a conglomeration of different personalities, all of which made for a very interesting workplace” he said.

“These people were risk takers. In order to be a successful trader at the Board of Trade, you had to have a personality that allowed you to

be a risk taker. And it was generally so for most of the legends that I named, although there was some inconsistency to them. It was usually

boom or bust, and you never knew what portion of their history they were going through at the time. Nevertheless it was all very interesting” explained Mr Rosenthal.

Yesterday, Rosenthal Collins Group contacted FinanceFeeds, its senior executives expressing their sadness at the loss of Mr Rosenthal, who was 84 years old when he passed away on Saturday.

J. Robert Collins, the firm’s other co-founder and Managing Partner, said: “Our hearts are heavy with the loss of one of the industry’s great leaders and my friend and partner for the past three decades. His breadth of knowledge, depth of experience, creativity and passion for the business helped make the futures industry what it is today. I will miss Les greatly, but it has been an honor to build and grow our business together and to ensure that we always put our clients first in every situation.”

RCG Chairman & CEO Scott Gordon said: “It’s been a profound privilege to work with Les over the better part of my career. He had the rare combination of qualities that made him so successful, not only as a visionary and strategist but as the most pragmatic person I’ve encountered. Our staff will miss his brilliance and sense of humor. While he won’t be around to see through some of the latest seeds we’ve planted for our growth, he made his imprint on the foundation we’ve laid in recent months, and we will proudly carry on the principles that he and Bob have instilled in our organization.”

Underlining FinanceFeeds admiration for Mr Rosenthal’s outstanding work during his career of thought leadership and his ability to actually make changes and move the business forward, Rosenthal Collins’ senior executives pointed out a phrase that Mr Rosenthal coined, reflecting his character, that being “Unless you do something to change with the times, you become non-existent.”

Mr Rosenthal is survived by his wife Harriet (nee Gross), sons David and Andrew, and daughter Arla, along with grandchildren Jack, Noah, Taylor and Sloane.

For those wishing to attend Shiva, this can be done via Chicago Jewish Funerals in Skokie, Illinois and contributions in his memory can be made to a charity of the contributors choice.

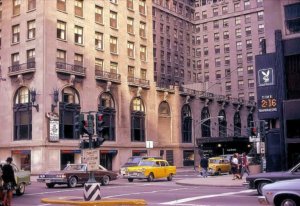

Image: Chicago during mid 1970s, in the heyday of Mr Rosenthal’s career.