OFX Group registers 7.7% Y/Y drop in net profit in H1 FY20

Statutory NPAT amounted to $8.3 million in the six months to end-September 2019.

Provider of online payment services OFX Group Ltd (ASX:OFX) has earlier today posted its financial results for the six-month period to September 30, 2019, with the data revealing an year-over-year drop in profits, although transactions marked growth.

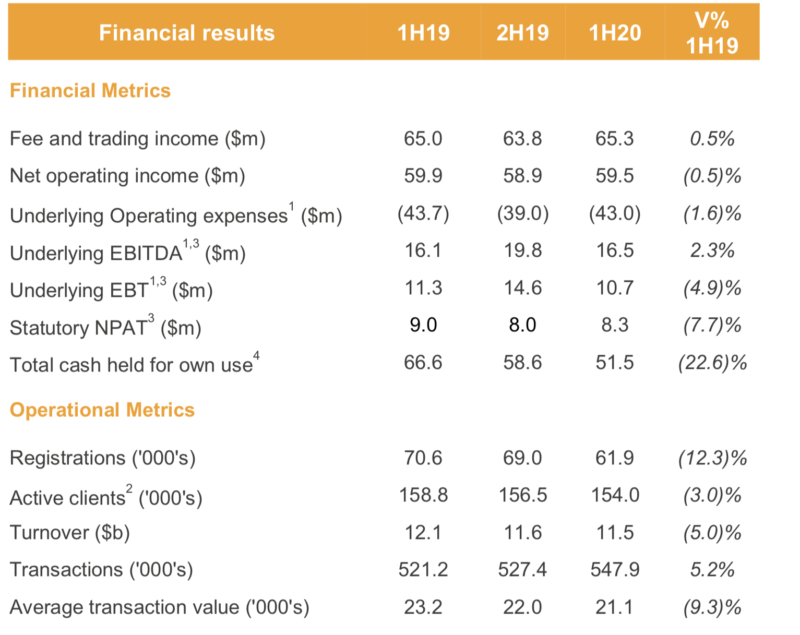

Turnover for the first half of FY20 was $11.5 billion, down 5% from the same period a year earlier. Transactions, however, were up 5.2% to 547,900. Transactions per active client marked a 9.3% rise to 7.0 on Active Clients of 154,000.

Fee and trading income (Revenue) were barely changed, up 0.5% to $65.3 million, with Corporate growing 9.7%, and North America growing 19.3%.

Net Operating Income (NOI) fell 0.5% to $59.5 million with stable margins, whereas Underlying EBITDA (excl. corporate action costs) increased 2.3% to $16.5 million.

Statutory NPAT (net profit after tax) decreased 7.7% to $8.3 million, reflecting $0.4m of corporate action costs, $0.4m increase in software intangible amortisation and $0.3m increase in lease depreciation.

OFX’s Chief Executive Officer and Managing Director, Skander Malcolm, said: “This was a solid result in what has been a difficult global economic environment. Revenue in North America, our key growth market was up 19% and in our Corporate business we grew revenue over 9%, despite global spot volumes declining by 14%1. We grew active clients in Corporate by 4% with transactions up 12%, reflecting our focus on building a more valuable portfolio. And our base of dependable, recurring revenue was consistent at 76%”.

“In line with this shift towards Corporate, our client activity improved significantly with transactions per active client up 9.3% to an average of 7 per annum. Overall transactions were up 5.2% although average transaction values (ATVs) declined 9.3% to $21.1k, reflecting subdued economic activity across global markets. This resulted in NOI being slightly down due to higher proportional transaction costs, despite a record second quarter for both NOI and revenue.”

Mr Malcolm also noted the partnership of OFX and Link Market Services Ltd. OFX will become Link’s preferred partner in Australia for international payments such as dividends for its substantial base of offshore investors. This will officially launch towards the end of FY20 and is poised to deliver progressive growth in OFX’s active client base as they are on-boarded to OFX.

OFX generated net cash flows from operating activities of $7.2 million during the six-month period to September 30, 2019.

The OFX Board of Directors declared an interim dividend of 2.35 cents per share, franked at 70%, with the dividend to be paid on December 13, 2019.