OFX Group registers rise in earnings in FY20 on the back of increase in transactions

Statutory net profit after tax was up 19% to AUD 20.3 million and Underlying NPAT was up 4.5% to AUD 21.4 million.

Provider of online payment services OFX Group Ltd (ASX:OFX) today posted a set of solid metrics for the full year to March 31, 2020.

All the company’s financial commitments were met including growing EBITDA on an underlying basis, delivering positive annual operating leverage, and maintaining stable Net Operating Income (NOI) margins.

The positive results were attributed to good execution, and the sound fundamentals underpinning OFX, such as a strong global platform, high-quality service delivery, healthy cashflows and no debt.

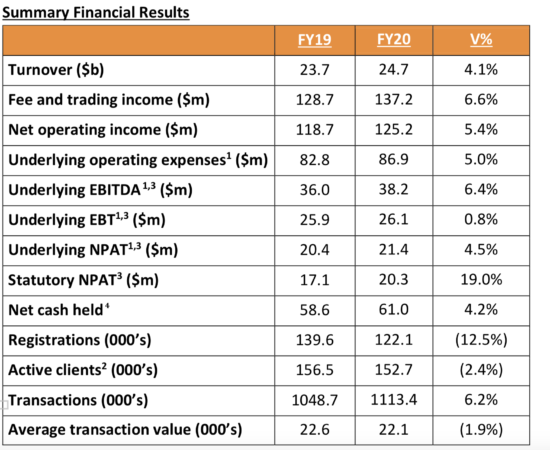

Turnover for FY20 amounted to AUD 24.7 billion, up 4.1% from the preceding year, whereas fee and trading income (Revenue) grew 6.6% year-on-year to AUD 137.2 million.

Net Operating Income was up 5.4% to AUD 125.2 million at stable NOI margins. This growth was driven by a 6.2% increase in transactions and an 8.8% increase in transactions per client. In the fiscal fourth quarter NOI was up 16.3% driven by market volatility. NOI margins were stable excluding IPS despite OFX’s Corporate book continuing to represent a higher proportion of its revenue.

OFX continued to deliver on its growth drivers with North America revenue up 24.1% and its Corporate segment revenue up 10.8%.

The Group saw good growth across all regions ex Asia. Australia and New Zealand continue to be the highest contributor to fee and trading income and grew at 4% in the year to end-March 2020. North America fee and trading revenue increased 24% in FY20. The European business increased fee and trading income by 5%.

Asia saw a reduction in fee and trading income of 4% as OFX took a deliberate pivot upon reviewing the business and market; OFX is expecting a return to growth as it targets prospects that better fit its value proposition.

The Group experienced an increase in bad and doubtful debts. Some 77% of the losses generated in North America and are largely driven by fraud. The Group has implemented further fraud controls with voice and face biometrics. OFX has seen the detection rates increase in March 2020.

Underlying EBITDA (ex. corporate action costs) marked a rise of 6.4% to AUD 38.2 million.

Statutory NPAT increased 19% year-on-year to AUD 20.3 million and Underlying NPAT was up 4.5% to AUD 21.4 million.

OFX reported 1.8 times normal call volumes and 17% more transactions in March on PCP with a 100% remote workforce.

OFX declared final unfranked dividend of 2.35 cents per share.

OFX’s Chief Executive Officer and Managing Director, Skander Malcolm, commented: “This was a strong financial and operating result for OFX in fluctuating macroeconomic conditions. Revenue was up 6.6% with good growth across our key metrics, and we delivered on our growth drivers with North America up 24.1% and our Corporate segment up 10.8%”.

“The investment we have made in our infrastructure and systems meant we were well prepared for the extreme market volatility we saw in February and March related to COVID-19, which stimulated strong trading activity across both our Consumer and Corporate segments”, he added.