One to one with ThinkForex CEO Nauman Anees on rebrand and development of proprietary platform

ThinkForex has become ThinkMarkets and released its entirely home-grown proprietary platform, ThinkTrader. FinanceFeeds speaks in detail to CEO Nauman Anees to look at the development of the platform, what critical points matter to today’s electronic brokerage business, and the company’s bright future

This week, ThinkForex completed its comprehensive rebrand, becoming ThinkMarkets, with an emphasis on providing its very own end-to-end trading solution.

The company joined the electronic trading giants of London in the summer of last year, when it established its operations in Copthall Street, in the Square Mile, nestling among the world’s largest institutional FX companies and some of the most prominent and longest established retail FX brokers in the world, most of which operate their own proprietary platforms.

ThinkForex this week clearly demonstrated its commitment to echoing the line of thinking that drives London’s establishment, itself going down the proprietary platform route and releasing ThinkTrader.

Holding an Australian license with highly regarded Antipodean regulator ASIC, ThinkForex made its way to London in June 2015, led by CEO Nauman Anees who, bases himself at the Copthall Avenue office, with the firm now holding an FCA license in Britain.

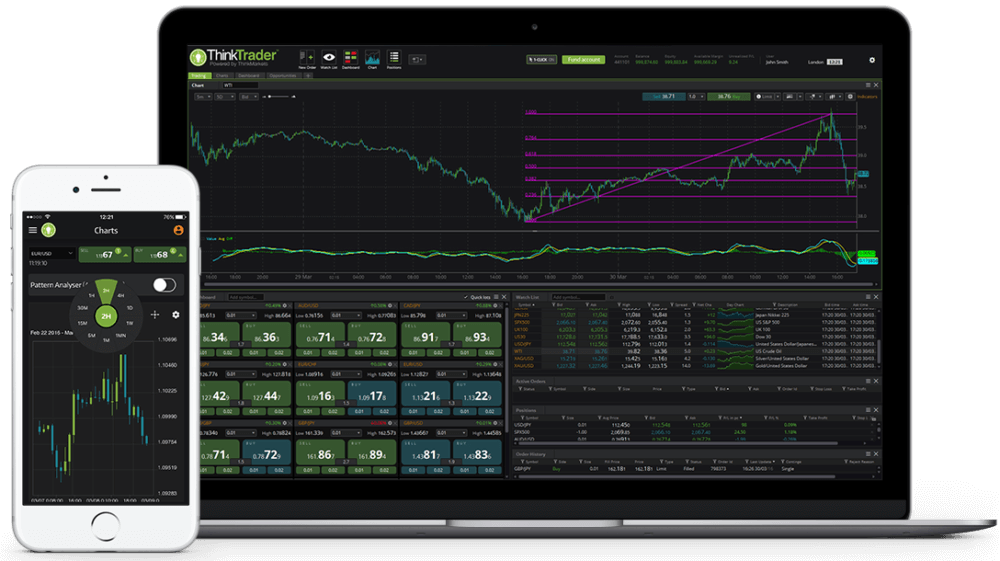

Today, Nauman Anees spoke with FinanceFeeds with regard to the rationale behind the rebrand, and to detail the stages of development for the new platform which is available in desktop format, as well as web, and for handheld devices.

Whilst continuing to offer the venerable and rather ubiquitous MetaTrader 4 alongside the new platform, ThinkTrader has been designed to move ThinkMarkets’ reach forward and has specific compatibility such as an integrated pattern analyzer which is provided by Autochartist.

Speaking to FinanceFeeds in London today, Mr. Anees said “ThinkForex started in 2010 with MT4 and only a few key Forex Pairs.”

“We dedicated ourselves to building our business on it with a handful of partners” continued Mr. Anees.

“Over the years we realized we needed to reach a much broader audience of traders who wanted to venture past “EA” trading and our clients and IB’s asked for a lot of features and changes we just simply could not cater to, as with any third party platform. Current day we offer FX, Indices, Metals and Energies, and have ambition to expand into equities and options as well” – Nauman Anees, CEO, ThinkMarkets

“As a result of this, we decided to Rebrand the company name and just simply change the word from “Forex” into ThinkMarkets and launch our new platform ThinkTrader.”

“The rebrand was not just about launching a platform and a new website it was about allowing us to achieve our ambitions of being the world’s largest broker using out Fintech model. There are larger firms in London but we believe we can compete on the same scale of acquiring new accounts , expanding our product lines faster and providing a personal touch when it comes to service with less resources as the lager players by using technology better” explained Mr. Anees.

In conclusion, Mr. Anees went into detail about the development of the platform, which has been designed from the ground up within the company. “Almost every key system that touches our customers is made in house , from our Client Portal , BackOffice Systems , and now the final Piece ThinkTrader. ThinkMarkets has always been forward thinking when it comes to the use of technology and as a growing player we can avoid the cost and overhead issues that some of the larger brokers may have.”

Mr. Anees elaborated on the journey that the company took with regard to the development of the new platform, was and what was taken into account, and what matters in the future with regard to retail FX platofrms and firms that needed to be considered to ensure ThinkForex stays ahead in today’s fast moving and technologically advanced electronic trading industry.

“There are many retail trading platforms and retail platform providers, however what makes any platform work for the clients and the broker is how that customer feedback and product roadmap is embedded into it” explained Mr. Anees.

“Simply making a platform with a fancy GUI doesn’t work anymore , you have to listen to your customers and build that feedback into the development cycles with commercial sense” – Nauman Anees, CEO, ThinkMarkets

“We took a considerable amount of time looking at platforms, considering our clients’ feedback, conducted case studies and took a close look at Mobile. ThinkTrader and ThinkTrader mobile were both created out of that process and were built for traders by direct feedback from active traders” he said.

“For example traders always get frustrated about speed and latency of their orders, in our new platform we optimized every piece of the process from using an advanced CDN on our entire network for ThinkTrader on Mobile , Desktop and Web. We optimized the data stream that is submitted to the radio towers with our CDN vendor on our Mobile App so that wherever you are in the world you receive lightning fast order execution and performance” concluded Mr. Anees.