OneConnect confirms coronavirus impact on project implementation

OneConnect’s operations have been impacted by delays in project implementation, client interactions and general uncertainty surrounding the duration of the government’s extended business and travel restrictions.

OneConnect Financial Technology Co., Ltd. (NYSE:OCFT), a major technology-as-a-service platform for financial institutions in China, has published its report for the final quarter and full year 2019, with the company confirming the impact of the new coronavirus on its operations.

In December, a novel strain of coronavirus was reported in China and more cases have since been confirmed. OneConnect says its operations have been impacted by delays in project implementation, client interactions and general uncertainty surrounding the duration of the government’s extended business and travel restrictions. The situation is highly fluid and full implications from the coronavirus on the results are uncertain at this point, the company says.

In the meantime, OneConnect has also been proactively working with existing and new customers to assist their shift to cloud-based solutions amid the interruptions. Products such as AI sales, AI risk management, AI customer service, smart office and smart claims allow financial institutions to continue their business operations online. OneConnect notes is well positioned to support financial institutions in all circumstances.

Regarding the results for 2019, the company saw rise in revenues but incurred a heavy net loss.

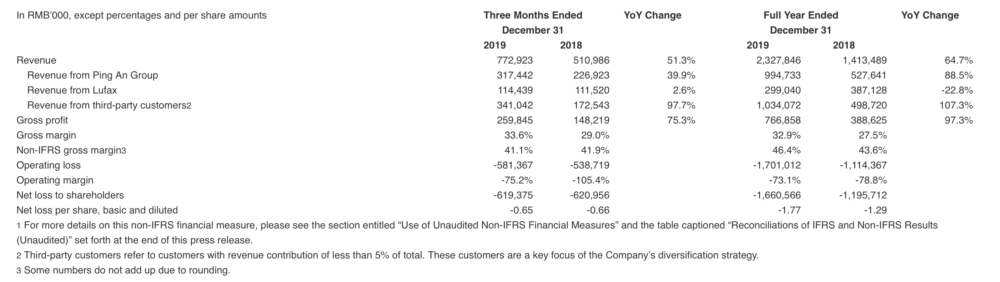

Revenue for the fourth quarter of 2019 increased by 51.3% to RMB773 million from RMB511 million in the prior year period.

Number of premium customers rose to 473 as of 31 December, 2019 from 221 a year earlier, reflecting strong uptick in cross-selling and transaction activities. Revenue from premium customers rose 51% to RMB1,306 million in 2019.

In banking, risk management modules were strengthened and AI virtual assistant was rolled out in 2019. AI virtual assistant was launched in insurance as well, together with agent management tools and intelligent rescue solution. In asset management, the smart contract module was introduced and aims to further enhance the ABS ecosystem by improving online management of contracts and digitalization of text.

OneConnect’s innovation was further promoted to global financial institutions. As of December 31, 2019, the Company had entered 14 markets outside of China. This expansion includes a joint venture with SBI in Japan, which started operations in December and aims to bring cloud-based AI technological services to regional banks throughout Japan. In the Philippines, the Company signed a partnership with UBX, the digital banking subsidiary of Union Bank, to use blockchain technology to address the financial service needs of the country’s SMEs.

On the downside, during the fourth quarter of 2019, net loss attributable to OneConnect’s shareholders was RMB619 million. Net loss attributable to OneConnect’s shareholders per basic and diluted share was RMB0.65, versus RMB0.66 for the same period in the prior year.

During full year 2019, net loss attributable to OneConnect’s shareholders amounted to RMB1,661 million, versus RMB1,196 million in the prior year. Net loss attributable to OneConnect’s shareholders per basic and diluted share was RMB1.77 from RMB1.29 in the prior year.