Optimus Futures

Optimus Futures is a discount futures brokerage geared towards beginner and advanced traders.

With access to many of the major exchanges around the world, customers can gain access to a wide array of futures contracts that cover everything from indexes to metals, currencies to cryptos. As a trader at Optimus Futures, you gain access to both larger future contracts and micro futures contracts.

Additionally, the company boasts clearing arrangements with some of the largest Futures Clearing Merchants (FCM) in the world.

Based out of Boca Raton, Florida, Optimus is an Independent Introducing Broker with over a decade in business as well as friendly and knowledgeable support staff. Optimus is a member of the NFA and registered with the CFTC.

Traders can open a demo account for free and establish an account with as little as $100.

As a discount broker, Optimus offers highly competitive commissions rates while allowing users the flexibility to choose data feeds and clearing firms to meet their individual needs.

Optimus provides a unique combination of education and technology. New accounts can access the full version of their flagship Optimus Flow platform that includes hundreds of technical indicators, real-time news feeds and a trading journal to tracks one’s performance.

Optimus Futures Pros and Cons

Pros

- Deep discount commissions, as low as $.10/contract for high volume traders

- Low Day Trading Margins, as low as $40 for MES and $300 for E-Minis

- Full-featured trading platform available upon opening an account

- Free Trading Journal – Instant one-click journaling from platform to journal

- Free Real-Time news alerts with actionable insights and detailed analysis

- As little as $100 to establish an account

- Extremely fast and efficient account application and funding/withdrawal process.

- Extensive education with free articles, guides, videos, podcasts, and trading community, all created in-house to serve active individual traders and investors.

Cons

- Wire fees can be high

- Only for futures traders

Where Does Optimus Futures Operate?

Optimus Futures accepts clients from all over the world with some exceptions where not permitted to conduct business with those countries.

Who is Optimus Futures Right For?

Optimus Futures caters to several different clients:

Beginning Traders: With excellent customer service, robust education, and an intuitive platform, Optimus Futures helps new traders learn the ropes and develop their strategies. Plus, retail traders can start out with unlimited simulated trades and before graduating to real money.

Advanced Traders: API developers and algorithmic traders seeking to get direct DMA over an infrastructure that reduces latency.

Investors: Optimus Futures offers clients Managed Futures opportunities by connecting clients with Commodity Trade Advisors (CTA). CTAs are professional investment advisors you select to manage and trade on your behalf.

Types of Accounts

Users can choose from four different account types: individual, joint, corporate, and IRA.

Optimus Futures provides an easy application process through its website with quick approval. Should you run into issues, they offer an extensive FAQ on their website along with telephone and email customer service.

Products Available

Optimus Futures offers traders some of the most extensive futures product selections.

Traders can choose from common futures contracts in markets such as:

- Energy

- Metals

- Currencies

- Bitcoin

- Global Indexes

- Treasuries

- Agriculture

While these assets all offer standard futures contracts, many offer micro contracts as well.

Micro futures contracts control 1/10th of the assets as a regular contract without sacrificing capital efficiency.

You can think of them as ‘bite-sized’ futures contracts that allow traders with smaller accounts a chance to hedge and speculate with less capital and smaller margin requirements.

Optimus Futures Commissions and Fees

As a discount futures broker, Optimus provides a free, fully functional platform and competitive rates with volume-tiered pricing breaks ranging from $0.50 per side for 0-20 average daily contracts to $0.10 for over 1,000 average daily contracts.

How Are Customer Funds Held?

Under Commodity Futures Trading Commission rule 1.20 (“CFTC 1.20”), customer funds with a Futures Clearing Merchant (FCM) must be held in segregation.

You can consult with an Optimus Futures representative as to the most appropriate FCM to you

Platform Features

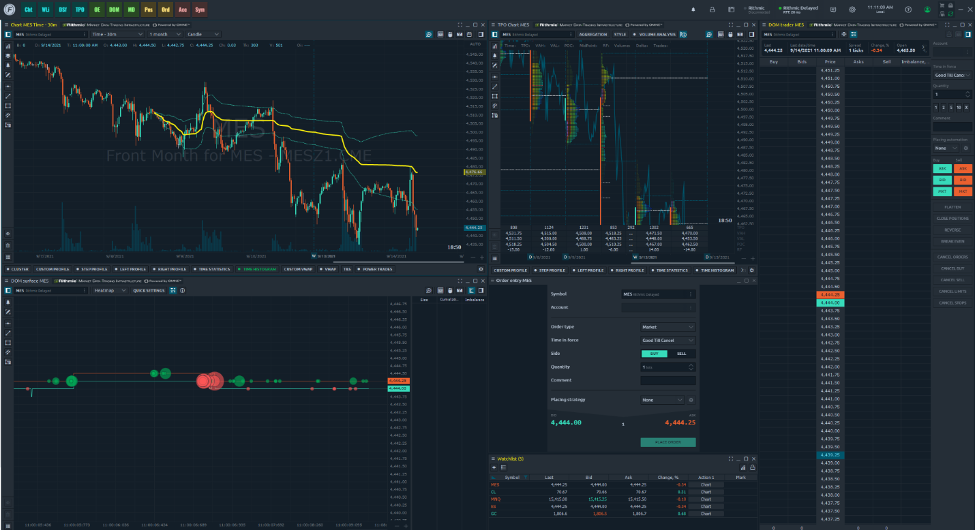

Optimus Futures offers clients two proprietary platforms to choose from: Optimus Flow desktop and web-based Optimus Trader.

The main platform is a quick download with an easy setup.

Navigation is intuitive with rich features and technical indicators including:

- Depth of market (DOM) surface analysis, tracking all liquidity changes in the order book and trading activity through the heatmap view

- Custom charting and indicators such as one-click custom VWAP

- Advanced orders including order-cancels-order (OCO), trailing stops, and time-based orders

- P&L alerts on each instrument

- A trading journal linked to all your accounts

- Real-time news alerts

Trading On All Devices – Desktop, Web and Mobile

One of the key benefits of working with Optimus Futures is their flexibility in data feed and clearing firm options. You can choose a desktop, web-based and mobile platform with the bonus that you can switch from one device to another while being tied to the same account and positions.

To test Optimus Flow: https://optimusfutures.com/OptimusFlow.php

To open an account with Optimus Futures: https://optimusfutures.com/Futures-Commodities-Trading-Account.php

Trading futures and options involves substantial risk of loss and is not suitable for all investors. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Aggressive day trading margins further your risk of gain and loss.