Phillip Securities rolls out POEMS Mobile 2.0

The new version of Phillip’s Online Electronic Mart System (POEMS) is now available on mobile devices.

Phillip Securities, a leading brokerage in Singapore, has launched POEMS Mobile 2.0, effectively making the latest version of the Phillip’s Online Electronic Mart System available on iOS and Android-powered gadgets.

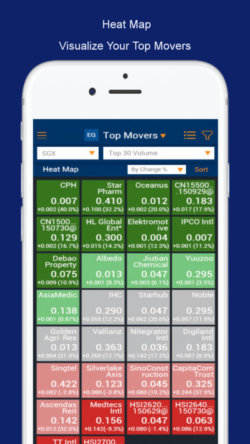

The list of key new features includes: Top Movers Heatmap, Integrated Account Management and POEMS Alerts.

Traders using the mobile apps may now make use of a mobile heatmap for global exchanges and top performing funds. Top Movers Heatmap allows customers to identify and track daily performance of market movement for Equities and Unit Trusts.

Traders using the mobile apps may now make use of a mobile heatmap for global exchanges and top performing funds. Top Movers Heatmap allows customers to identify and track daily performance of market movement for Equities and Unit Trusts.

Integrated Account Management allows customers to access their multi-asset Portfolio, Outstanding Positions and Transaction History with one login. In addition, online forms for currency conversion and cash withdrawal are now available on POEMS Mobile 2.0.

POEMS Alerts – another new feature, cover all asset classes (except Futures) on POEMS Mobile 2.0. Customers will be alerted on price movement, order status, promotion and account-related transactions.

Other functionalities that the application offers include multi-asset advanced charting, as well as smart, multi-lingual news. There is also an FX Invest functionality, as well as advanced order types for stocks and CFDs.

Security is taken into account too thanks to two-factor authentication and transaction token auto-renewal.

Early this year, the POEMS family of platforms was enlarged via the launch of POEMS Mercury. The company chose the name based on the qualities of the chemical element Mercury which is used in thermometers to indicate minute changes in temperature. The substance is sensitive and fluid, as markets are fluid and fast-changing.

The multi-market and multi-screen platform provides trading with instruments across seven global exchanges. POEMS Mercury also allows docking and linking of multiple modules and it supports dual-language. The range of order types is wide, including advanced order-types such as Stop-Limit and If-Done with various validities to help traders manage their order execution better and more efficiently. Extensive technical insights are provided thanks to over 40 indicators on Chart View. The Workspaces & Settings are fully customizable, whereas traders can configure price and order alerts as they please (including a variety of sound files).