Plus500 directors secure pay hike approval

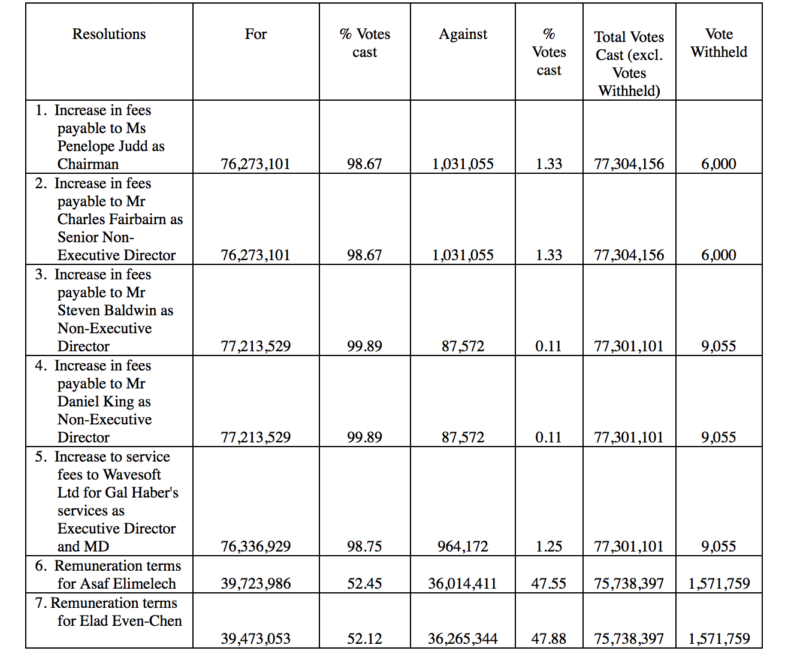

The amended remuneration terms for Asaf Elimelech and Elad Even-Chen, however, were approved by a narrow majority of votes.

In line with FinanceFeeds’ earlier report about an extraordinary general meeting that Plus500 Ltd (LON:PLUS) was planning, the online trading services provider has just published the results of the meeting.

Let’s recall that Plus500 said back in December that after its move in June 2018 from AIM to the premium list of the Main Market of the London Stock Exchange and the company’s inclusion in the FTSE 250 Index, the Remuneration Committee considered that it is appropriate to change the current remuneration arrangements and move towards a structure more in line with investor remuneration guidelines and developments in best practice.

The Remuneration Committee has developed a new remuneration structure “which is sensitive to the UK listing environment and associated corporate governance best practice where appropriate”.

At today’s meeting, all resolutions were duly passed. And yet, not all of them were applauded.

In particular, the resolutions concerning the remuneration terms for Asaf Elimelech and Elad Even-Chen barely got approved.

Let’s recall what these resolutions (6 and 7) were about.

Plus500’s Board has proposed to approve the following remuneration terms for Mr. Asaf Elimelech, the Chief Executive Officer and an Executive Director of the Company:

(a) An increase to the service contract fee payable to Mr. Elimelech for his services as Chief Executive Officer and Executive Director from NIS 1,100,000 per annum to NIS 1,700,000 (approx. USD 460,000) per annum, effective January 1, 2019.

(b) The payment to Mr. Elimelech of an annual bonus for the year ending 31 December 2019.

(c) The grant to Mr. Elimelech of a share appreciation right in the amount of NIS 2,500,000 (approx. USD 675,000) vesting after two years from the date of grant, with a maximum payout amount of NIS 10,000,000 (approx. USD 2,700,000). Subject to the approval of this Resolution by the Company’s shareholders at the Extraordinary General Meeting, the effective grant date of the share appreciation right shall be 31 December 2018.

(d) The grant to Mr. Elimelech of an LTIP award with an aggregate value of NIS 1,000,000 (approx. USD 270,000).

To approve the following remuneration terms for Mr. Elad Even-Chen, the Chief Financial Officer and an Executive Director of the Company:

(a) An increase to the service contract fee payable to Mr. Even-Chen for his services as Chief Financial Officer and Executive Director from NIS 1,100,000 per annum to NIS 1,700,000 (approx. USD 460,000) per annum, effective 1 January 2019.

(b) The payment to Mr. Even-Chen of an annual bonus for the year ending 31 December 2019.

(c) The grant to Mr. Even-Chen of a share appreciation right in the amount of NIS 2,500,000 (approx. USD 675,000) vesting after two years from the date of grant, with a maximum payout amount of NIS 10,000,000 (approx. USD 2,700,000). Subject to the approval of this Resolution by the Company’s shareholders at the Extraordinary General Meeting, the effective grant date of the share appreciation right shall be 31 December 2018.

(d) The grant to Mr. Even-Chen of an LTIP award with an aggregate value of NIS 1,000,000 (approx. USD 270,000).

In addition, Mr. Elimelech and Mr. Even-Chen shall each be entitled to an annual bonus for the year ending December 31m 2019 as determined by the Remuneration Committee, consisting of the following:

(a) an annual bonus of up to 240% of the annual service contract fee (NIS 4,080,000 (approx. USD 1,102,000)) shall be payable subject to compliance with profitability criteria (the “Profitability Bonus”);

(b) an annual bonus of up to 160% of the annual service contract fee (NIS 2,720,000 (approx. USD 736,000)) shall be payable subject to compliance with regulatory and operational criteria (the “Regulatory Bonus”); and

(c) a discretionary annual bonus, in an amount and on payment terms as determined by the Remuneration Committee.

Today, Plus500 said the Board, with the support of the Remuneration Committee, takes these votes seriously, and will consider shareholder feedback to ensure it is better understood and implemented as appropriate. The Board also reiterates its commitment to achieving the highest governance standards.