Plus500 registers 129% jump in client acquisition costs in Q3 2018

Average user acquisition cost rose 129% from a year earlier to $1,581 in the third quarter of 2018, with the broker blaming the change on low volatility.

Online trading company Plus500 Ltd (LON:PLUS) has just posted an update on its performance during the third quarter of 2018, with the numbers showing a drop in revenues and a rise in client acquisition costs.

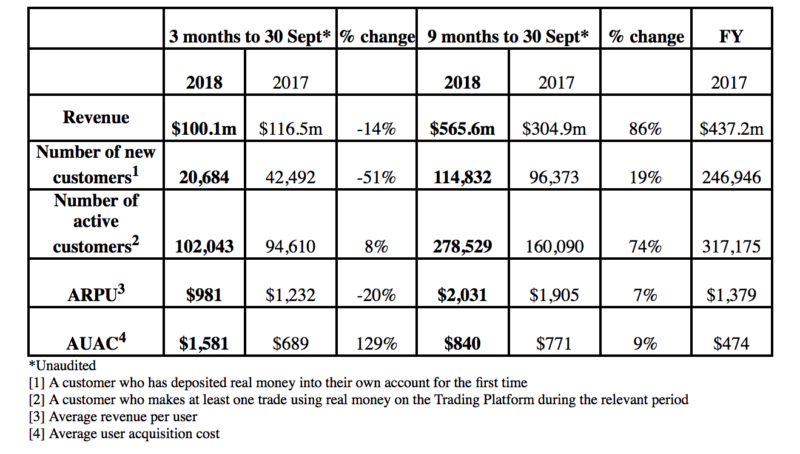

In the three months ended September 30, 2018, Plus500’s revenue was $100.1 million, a decrease of 14% compared to the same period last year. The broker explained that this period included two months (August and September) of trading post the newly implemented ESMA regulations for CFD offering to retail clients, which became effective August 1, 2018.

The impact of lower leverage on Plus500 retail EEA clients has been as expected, the broker says. Low market volatility has affected ARPU (average revenue per user), which decreased to $981 in the third quarter of 2018 compared to $1,232 in the same period in 2017.

The low market volatility also impacted the level of New Customers and AUAC in the quarter, Plus500 said. AUAC increased to a level of $1,581 in the third quarter of 2018 compared to $689 in the corresponding period a year earlier.

In terms of client base, Plus500 said that approximately 8% of EEA customers have now elected to become professional clients representing approximately 38% of Q3 EEA revenues. Whether the fact that the customers have “elected” a certain status means that they are in fact professional, was not explained in today’s announcement.

Plus500 did not mention anything about Playtech’s sale of its entire shareholding in the broker. Nor did it mention anything about its founders selling approximately 9.4 million shares in the company.

The broker, however, made the following statement:

“Plus500’s Board has approved a programme to buy back an initial amount of up to $10 million of the Company’s shares in accordance with the authority granted at the Company’s AGM. With effect from today, the Company has appointed Liberum Capital Limited (“Liberum”) to manage an irrevocable, non-discretionary share buy-back programme to repurchase on its behalf, and within certain parameters”.