Plus500 registers 60% drop in net profit in 2019

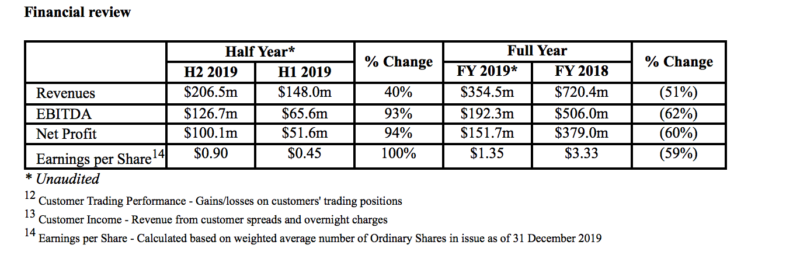

The broker reported net profits of $151.7 million for 2019, down 60% from a year earlier.

Online trading company Plus500 Ltd (LON:PLUS) has just reported its preliminary results for 2019, with revenues and profits sliding from 2018 levels.

Total revenues for 2019 amounted to $354.5 million, down 51% from $720.4 million registered a year earlier.

EBITDA for 2019 was $192.3 million (FY 2018: $506.0 million), with an EBITDA margin of 54% (FY 2018: 70%). Net profit for 2019 was $151.7 million, down 60% from $379 million registered a yea earlier. Earnings per share were $1.35 (FY 2018: $3.33).

Average User Acquisition Cost failed to deliver any positive news either, as it increased 12% on 2018 levels and reached $1,046 in 2019. Plus500 said this reflected its investment in marketing to recruit new higher value customers.

In terms of global regulatory environment, Plus500 noted that, in August 2019, the Australian Securities and Investments Commission (ASIC) released a consultation paper which sets out its proposals to exercise its power to make certain market-wide product intervention orders and imposing certain restrictions on the sale and marketing of CFDs to retail customers. This is anticipated to take place during 2020. Plus500 expects these changes to result in a similar impact on the industry as ESMA’s intervention measures had in Europe during 2018-2019. Plus500’s 2019 revenues for Australian residents represented a total of approximately 14% of Group revenues.

Regarding Brexit, Plus500 says it is well prepared for various scenarios for the UK’s exit from the EU, supported by the Group’s separate EU licence in Cyprus which enables it to operate in EU regulated jurisdictions, in line with applicable regulatory requirements.

Following the year end, in January 2020, a new licence was granted to Plus500 by the Financial Services Authority in the Seychelles.

Let’s note that, in a separate announcement issued today, Plus500 said it intends to conduct a further share buyback program in 2020 to purchase up to $30 million of its shares.