Plus500 registers rise in revenues and active customers in Q3 2019

In the quarter to end-September 2019, Plus500’s revenue was $110.6 million, an increase of 10% compared to the same period last year.

Online trading company Plus500 Ltd (LON:PLUS) has earlier today provided a trading update for the the third quarter of 2019. The data shows a rise in revenues and the number of customers.

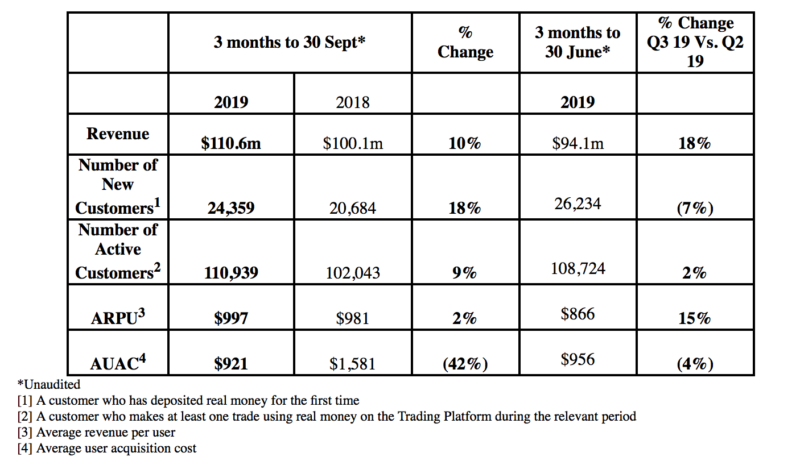

During the three months to end-September 2019, the Group’s revenue was $110.6 million, up 10% from the same period last year when the revenues amounted to $100.1 million. Plus500 attributed the rise to geopolitical events in the quarter, with the heightened activity reflected in trading patterns.

The number of active customers increased to 110,939 in the period, a rise of 9% on the previous year. New Customer acquisition also improved, up 18% compared to the same period last year. The company also saw a 42% fall in average user acquisition costs (AUAC) to $921 per customer. Average revenue per user (ARPU) showed a 15% sequential improvement, and a year-on-year increase of 2%.

EBITDA in the third quarter of 2019 amounted to $70.1 million, a 39% increase in comparison to the corresponding period a year earlier, with expansion of EBITDA margin to 63% in the third quarter of 2019 from 57% in the second quarter of 2019. The margin was 50% in the third quarter of 2018.

The company notes that trading for the first nine months of 2019 remains in line with current expectations for the year as a whole.

The brokerage also provided an update on the progress of its share buyback program. The company repurchased 1,639,246 shares in the quarter for a total consideration of $14.7 million as part of its $50 million share buyback program that started on August 20, 2019.

In terms of regulatory outlook, Plus500 noted the release of a consultation paper by the Australian Securities and Investments Commission (ASIC) regarding potential product intervention measures to be introduced in Australia.

Plus500 says it continues to assess the potential impact on the c.15% of Group revenues contributed by Australian clients in the nine months to end-September 2019. The Board believes that the introduction of the measures will, over time, reduce the number of its competitors, enabling it to gain increased market share at lower customer acquisition cost. Plus500’s Board therefore expects to see a pattern similar to that in Europe to evolve in Australia.