Plus500 registers steep drop in revenues in Q1 2019

Revenues dropped 65% from the preceding quarter, due to subdued financial markets.

Online trading company Plus500 Ltd (LON:PLUS) has earlier today posted a trading update for the three months to March 31, 2019, with the report revealing a rather dull picture.

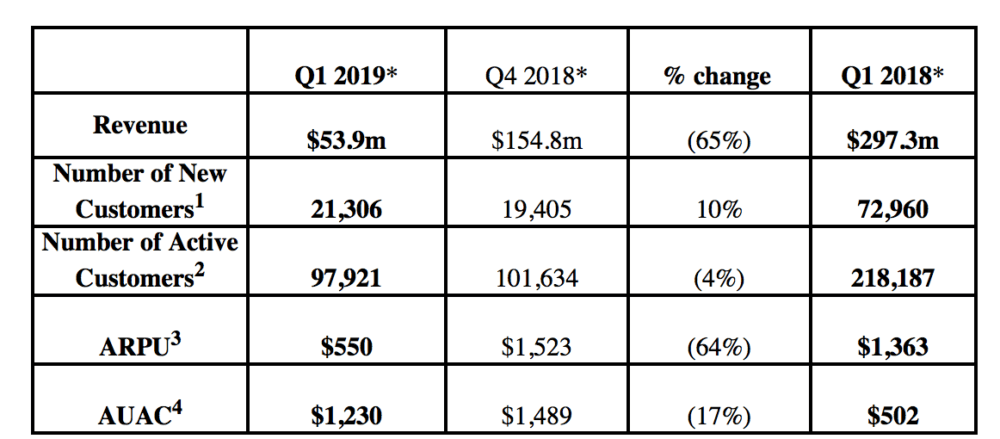

Group revenue for the first quarter of 2019 was $53.9 million, this is down by 65% from the revenues of $154.8 million registered in the final quarter of 2018. The drop is even steeper in annual terms, as the revenues in the first quarter of 2018 amounted to $297.3 million. The brokerage blamed the decline on extremely subdued financial markets across most asset types.

The low levels of volatility impacted Active Customer numbers and ARPU. There were 97,921 Active Customers in the period, down 4% on the previous quarter. Average revenue per user was meager $550 in the first quarter of 2019, down from $1,523 in the final quarter of 2018 and down from $1,363 in the first quarter of 2018.

Average user acquisition costs were $1,230 in the first quarter of 2019, down from $1,489 in the preceding quarter but markedly higher from $502 in the first quarter of 2018.

The company did not provide any particular forecasts about its future performance. It just said that it is impossible to predict market conditions for the rest of the year and therefore too early to draw conclusions about the full year outcome based on the Group’s performance over the first three months.

Earlier this year, Plus500 published a rather downbeat forecast for FY2019. Back in February, the company said:

“Following our latest assessment of the impact of the ESMA regulatory measures, FY19 revenue is expected to be lower than current market expectations. This, combined with our intention to maintain our marketing spend, is likely to result in 2019 profit being materially lower than current market expectations”.