Plus500 starts buying shares under new share buyback program

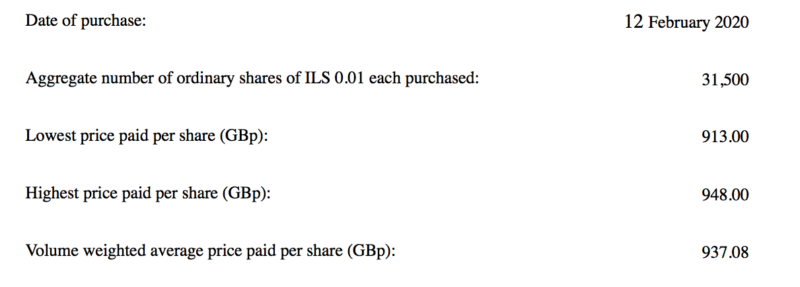

On February 12, 2020, the broker purchased 31,500 shares under the new share buyback program.

Online trading company Plus500 Ltd (LON:PLUS) today announces that, in accordance with the terms of its new share buyback program announced on February 12, 2020, the company purchased 31,500 of its ordinary shares of ILS 0.01 each through Credit Suisse Securities (Europe) Limited.

The transactions were executed on February 12, 2020, with the volume weighted average price paid per share (GBp) being 937.08.

Let’s note that Plus500’s Board has approved a new program to buy back up to an additional $30 million of the company’s shares, following the completion of the $50 million buyback programme announced on August 13, 2019.

Share purchases will take place in open market transactions and may be made from time to time depending on market conditions, share price, trading volume and other factors.

Plus500 has selected Credit Suisse Securities (Europe) Limited to manage an irrevocable, non-discretionary share buyback program to repurchase the company’s shares on its behalf, and within certain parameters. Plus500 and its directors have no power to invoke any changes to the program and it will be conducted at the sole discretion of CS.

The share buyback program will run to August 31, 2020 or, if earlier, the date of the announcement of the company’s interim results for the six months to end-June 2020.

Plus500’s shareholders authorised the buyback of up to 11,333,676 shares at the company’s annual general meeting held in June 2019, of which 5,008,920 shares were purchased as of February 12, 2020, under the completed August 2019 Program.