Plus500 tries to strike upbeat note on H1 performance but revenues still down from year earlier

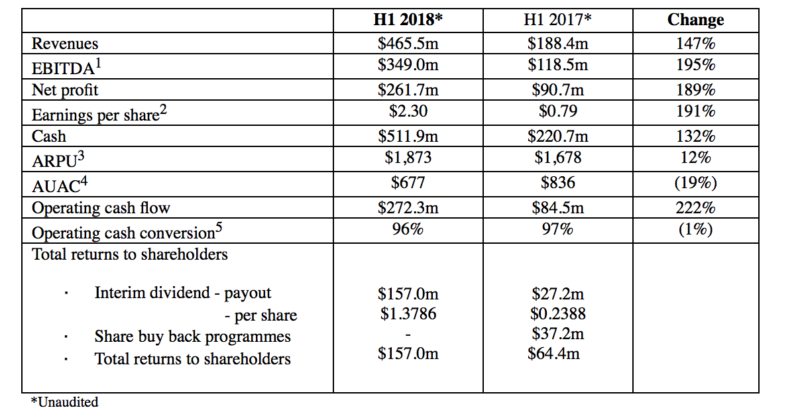

The company reports revenues of $148m for the first half of 2019, which is way below the revenues of $465m registered in the year-ago period.

Online trading company Plus500 Ltd (LON:PLUS) has earlier today posted a trading update, with the announcement marking the apparent effort of the brokerage to stay upbeat in the face of headwinds.

Plus500 says that, following a first quarter which was impacted by low levels of volatility in financial markets, revenue for the second quarter increased to approximately $94 million (Q1 2019: $53.9 million), giving a total of approximately $148 million for the first half. Although there is some improvement in revenues when compared to the first quarter, the annual comparisons are still dismal. In H1 2018, the revenues were $465.5 million.

The level of client spreads and overnight charges for the second quarter was approximately $93 million (Q1 2019: $82 million), giving a total of approximately $175 million for the first half.

During the first half of 2019, around 48% of revenue was generated outside the EEA, whilst approximately 23% of revenue was generated by Elective Professional Clients within the EEA, Plus500 said today.

Earlier this year, Plus500 published a rather gloomy forecast for FY2019. Back in February, the company said:

“Following our latest assessment of the impact of the ESMA regulatory measures, FY19 revenue is expected to be lower than current market expectations. This, combined with our intention to maintain our marketing spend, is likely to result in 2019 profit being materially lower than current market expectations”.