Plus500’s founder Alon Gonen buys 445,064 shares in company

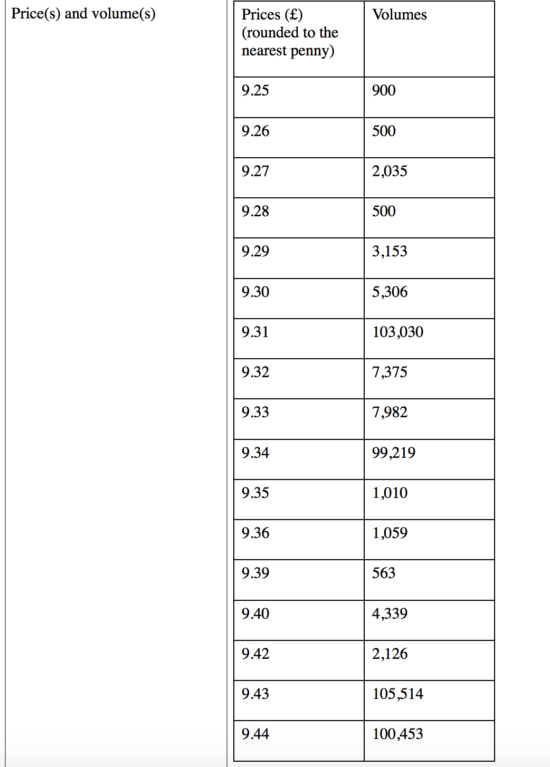

He purchased a total of 445,064 shares at an average price of £9.38 per share in a transaction dated March 2, 2020.

Plus500 Ltd (LON:PLUS) has just reported that one of its co-founders – Alon Gonen, has purchased more shares in the online trading company.

A regulatory filing says that Mr Gonen has acquired shares of NIS 0.01 each in the company (“Ordinary Shares”). He purchased a total of 445,064 shares at an average price of £9.38 per share. The transaction is dated March 2, 2020.

The shares were acquired via Sparta 24 Ltd.

Let’s note that, in December 2019, Mr Gonen purchased an aggregate of 500,000 shares in Plus500 at an average price is £7.634 per share.

On August 19, 2019, Plus500 reported that it was notified that certain PDMRs have acquired shares of NIS 0.01 each in the company. The company said back then Alon Gonen acquired 468,469 shares (through Sparta 24 Ltd.) at £7.07 per share.

The brokerage has recently struck an upbeat note about its performance. In a trading update issued on February 28, 2020, Plus500 reported a significant increase in levels of customer trading activity. The Group’s financial performance during the first quarter to date is consequently trending substantially ahead of the last quarter of 2019, Plus500 said.