Plus500’s results disguise grave reality of cryptocurrency insecurity

Plus500 states that cryptocurrency CFD trading only accounted for 15% of all revenues, yet user acquisition cost was massively reduced by being able to target cryptocurrency web traffic en masse. Either it’s popular, or it’s not. The proof is in analyzing the figures – so that’s what we have done

A combination of very astute accountancy and the framework within which revenues and commercial metrics must be reported by British publicly listed companies can provide the basis for a very clever means of disguising a temporary mishap, even if said mishap is gargantuan.

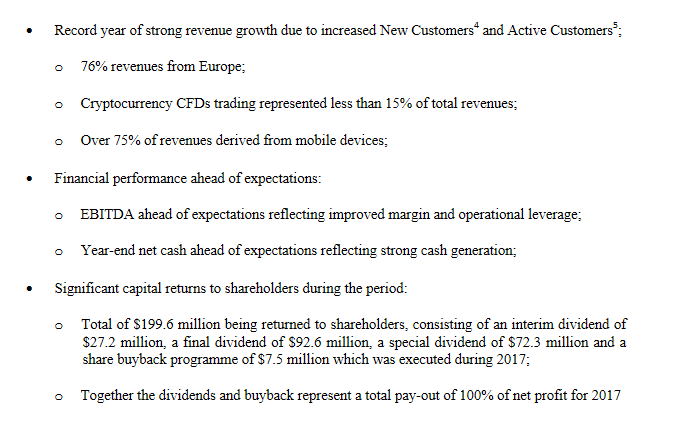

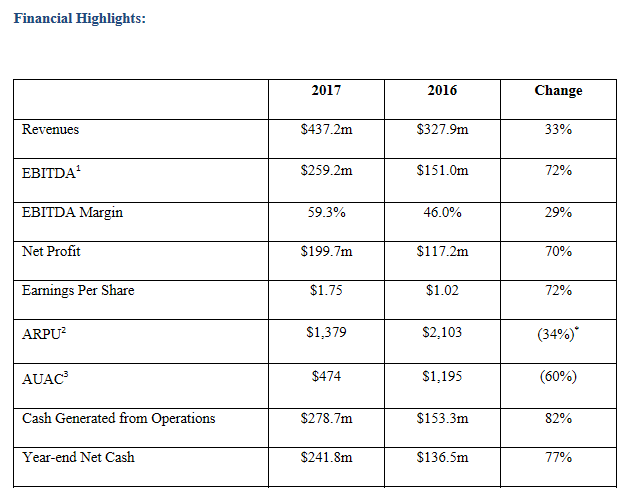

This morning retail FX brokerage Plus500 declared its eagerly awaited preliminary results for the year ending December 31, 2017, painting a very rosy picture and demonstrating to shareholders and customers alike that the company has indeed maintained its reputation for lean efficiency and revenue generating prowess.

The results, however, represent an entire business year, and thus figures shown could easily smooth out a momentary blip that had been experienced over a short period of time.

Once again, the elephant in the room here is cryptocurrency CFD trading, which Plus500, along with several other marketing-led retail FX brokerages plunged headlong into during the latter quarter of 2017.

FinanceFeeds research has deduced that in terms of OTC retail FX volume globally (which of course is very hard to measure as a genuine yardstick due to the non-transparent means of reporting, however our relationship with Tier 1 banks gives as good a measure as any), Bitcoin trading rose to dominance over the year.

In January 2017 trading volume for BTCUSD constituted just 0.47%, however as the trend to trade Bitcoin continued to accelerate throughout 2017, a total trading volume of 6.36% was recorded in July and then finally reached its peak in the month of December, representing an incredible 42.5% of total volume.

For companies which major on digital marketing such as Plus500, it would be very prudent to assume that the cryptocurrency direction would have been majored on significantly, largely due to the number of searches conducted by internet users globally, the company would have targeted its campaigns toward those looking for cryptocurrency related websites.

The figures provided by Plus500, however, show a different circumstance completely.

The company reported that its acquisition cost per active user was lower due to efficient and successful marketing strategy and popularity of our cryptocurrency CFDs offering which attracted new customers mainly in Q4 2017, however the company claims that over the course of an entire year, CFD cryptocurrency trading accounted for just 15% of the entire annual revenue.

This appears contradictory. Either it is popular, or it is not.

As mentioned previously, Plus500’s digital marketing orientated corporate ethos would certainly mean that the company would actively chase the wave of cryptocurrency obssessions that are currently pervading the internet in order to display as many ‘call to action’ advertisements as possible and bring those cryptocurrency-obsessed users into the Plus500 fold. That is clear and is most certainly aligned with digital marketing strategy.

On the other hand, only 15% of revenues were gained from cryptocurrency trading during the course of the year. Here, it is important to note that the revenues averaged out during the course of the year have been contributed to by only 15% from cryptocurrency CFD trading, however the last quarter’s user acquisition cost went down.

This suggests a massive onboarding of cryptocurrency customers in the final quarter of 2017, which was the period during which several brokerages lost an absolute fortune due to having adopted it.

There were reports in December last year from very reliable sources within the FX industry that companies that went large on advertising cryptocurrencies to retail traders and offered CFDs with leverage had caught a nasty cold, in some cases losing tens of millions of dollars.

At that time, FinanceFeeds contacted Plus500 for a comment on this matter, and no such reply was forthcoming.

FinanceFeeds was at the time provided with documentation that demonstrates substantial losses sustained by the few retail brokerages that have allowed unrestricted cryptocurrency trading on their platforms, and unlike losses sustained by firms that transfer their orders to liquidity providers and become exposed to negative client balances in the case of extreme and unpredictable market volatility, as per the Swiss National Bank’s removal of the EURCHF peg in January 2015, these are losses sustained by categorically ‘b-book’ brokerages which internalize their trades.

This led to an inability to pay affiliates for a short period of time, indicating the affectation of cash flow.

There is no way to price or clear Bitcoin trades. No liquidity provider or prime brokerage will entertain it, as it is not a centrally issued currency, and Tier 1 banks only deal in centrally issued currency when extending counterparty credit to FX brokerages, hence its status as a commodity, and hence its position as a catalyst toward instability should the prices fall or rise dramatically, as it is completely synthetic.

It is indeed remarkable that in these times of very high customer acquisition costs, Plus500 managed to reduce this to $474, which is less than half the average cost of acquisition in the retail FX brokerage sector worldwide, however the analysis of the figures indicate toward the instability that cryptocurrency can wreak.

For Plus500, attracting vast numbers of new customers via targeting the cryptocurrency related searches may well be a means of onboarding clients for other asset classes, which would be a very clever marketing strategy indeed.

The hands off approach to customer onboarding which characterizes Plus500 and has been one of the keys to its success is a bete noir for the British regulators, the FCA having intervened in the company’s operations in 2015. Had the firm not had enough capital to smooth the crypto bubble over in its annual report, it is likely that a red flag would have been raised regarding exposing unknown customers with unknown trading skills and unestablished product suitability to very risky and highly leveraged peer to peer products with no central issuer and no backing.

Given the fiscal might of Plus500, this marketing strategy could well have paid off as shown in the figures here, however, for other firms, especially those less marketing led or less well financed, it would be prudent to avoid.