Plus500’s top management buys shares in company

A number of top-ranking officers of Plus500, including Asaf Elimelech and Elad Even-Chen, have purchased shares in the brokerage over the past couple of days.

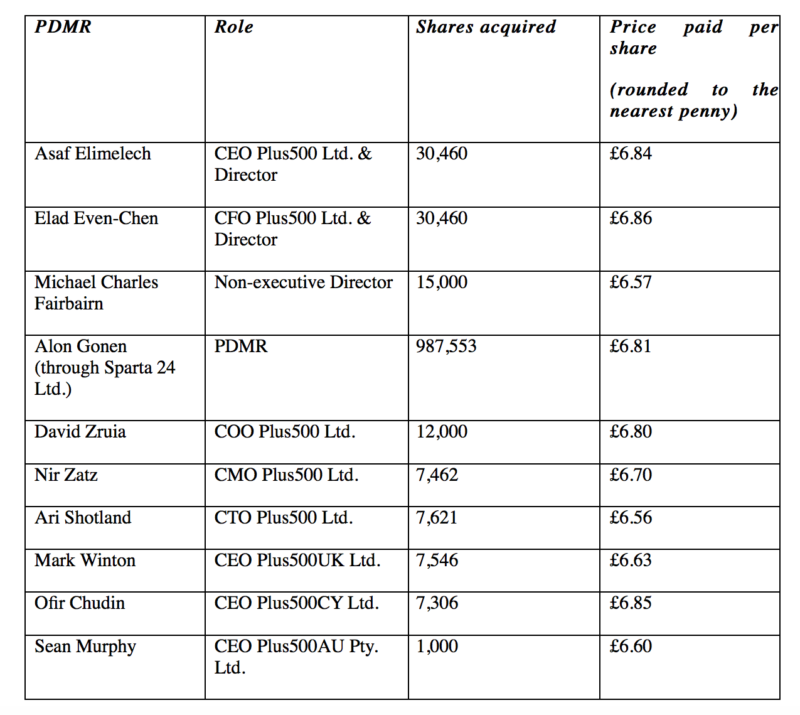

Online trading company Plus500 Ltd (LON:PLUS) has earlier today reported a number of transactions in its shares by Directors and PDMRs.

- Asaf Elimelech, CEO of Plus500 Ltd, acquired 460 shares in the brokerage at a price of £6.8200 per share and 30,000 shares at a price of £6.8370. The transactions were executed on August 14, 2019.

- Elad Even-Chen, CFO of Plus500 Ltd, acquired 30,460 shares at a price of £6.858 per share. The transactions were executed on August 14, 2019.

- Mark Winton, CEO of Plus500UK Ltd, acquired 7,546 shares at a price of £6.62529 per share on August 13, 2019.

- Ofir Chudin, CEO of Plus500CY Ltd, acquired 7,306 shares in Plus500 Ltd, whereas Sean Murphy, CEO of Plus500AU Pty. Ltd, bought 1,000 shares.

Earlier this week, Plus500 Ltd posted its results for the first half of 2019, with revenues and profits markedly down from a year earlier.

For the six months ended 30 June 2019, net profit was $51.6 million, down 80% from the $261.7 million registered in the equivalent period in 2018. Revenues in the first half of 2019 amounted to $148 million, down 68% from $465.5 million registered in the first half of 2018. The company blamed the drop on the low volatility within the first quarter of 2019.

The Board announced an interim dividend of $0.2734 per share (H1 2018: $1.3786), a total pay-out of $31 million, representing 60% of net profit in the period. The ex-dividend date is 29 August 2019, the record date 30 August 2019 and payment date 28 November 2019.

Further, the Board announced a share buyback programme to purchase up to $50 million of the Company’s shares.