Advanced Markets Group joins LiquidityFinder

“The significant gap between the institutional and retail spaces that has not been bridged even considering that over two decades have passed since the vast increase in the popularity of retail FX began” says Advanced Markets senior executive Natallia Hunik

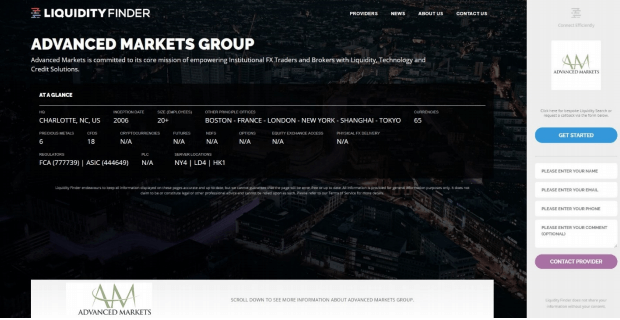

Liquidity Finder Ltd, (LiquidityFinder) is pleased to announce that Advanced Markets Group, a leading Prime of Prime Liquidity Provider, which is authorized and regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) has joined its interactive website www.liquidityfinder.com.

LiquidityFinder is a liquidity solutions search tool that provides a consolidated view of liquidity providers for institutional and professional market participants looking for eFX, CFD, multi-asset liquidity and other OTC electronic markets.

Advanced Markets Group consists of Advanced Markets LLC, Advanced Markets Ltd and Advanced Markets (UK) Ltd, and provides trade execution and superior solutions to banks, hedge funds, commodity trading advisers, corporations and other institutional market participants.

Advanced Markets Group provides an extensive range of educational materials

Founder of LiquidityFinder, Sam Low said “Advanced Markets Group (AMG) is one of the very first companies in what is now called the ‘Prime of Prime’ space, having been offering true Agency eFX liquidity since 2006. The deep experience the company has gained in this time is shared with the broader market through their extensive range of educational materials, articles, blogs and YouTube videos. All this content will be consolidated on their page on LiquidityFinder (as it is already on their own site), further enhancing the site’s educational value.”

He further commented “Having Advanced Markets Group join LiquidityFinder further validates the site as a one-stop venue for comparing and directly contacting those liquidity providers that could potentially meet your business requirements. Advanced Markets Group can now be included in any RFI/RFP from the Comparison and Contact pages on LiquidityFinder.”

“We are pleased to be joining the LiquidityFinder portal, as this is the first directory of its kind that features players from B2B space” said Natallia Hunik, Global Head of Sales at Advanced Markets Group.

“The FX Market is dynamic and complex, with a significant gap between the institutional and retail spaces that has not been bridged even considering that over two decades have passed since the vast increase in the popularity of retail FX began. This gap has widened even further post credit-tightening. There is a lot of liquidity recycling going on, which doesn’t add value and introduces inefficiencies into the marketplace” continued Ms Hunik.

“Using LiquidityFinder, new entrants and existing players looking for genuine institutional liquidity will be aided with detailed, vetted information that will help them to make the right decision about their liquidity sourcing.”she concluded.