Advanced Markets Group partners with Autochartist

“”We are pleased to officially partner with Autochartist – one of the industry’s most reputable chart pattern recognition and analysis software companies, with a suite of products that enables traders, worldwide, to take advantage of market opportunities” – Natallia Hunik, Global Head of Sales at Advanced Markets Group.

Advanced Markets Group is pleased to announce its partnership with the Autochartist group of companies.

Advanced Markets Group consists of Advanced Markets LLC, Advanced Markets Ltd and Advanced Markets (UK) Ltd, and provides price liquidity, trade execution and superior solutions to banks, hedge funds, commodity trading advisors, corporations and other institutional market participants.

The goal of this partnership is to increase customer acquisition, trading activity and retention for customers of Advanced Markets. This will happen through a number of broker-centric products provided by Autochartist and its group of companies.

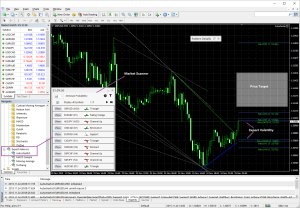

Although Autochartist is well known for its client-facing functionality, it has recently expanded its offering into numerous tools that integrate, and improve, brokers’ sales automation and retention processes.

“We are pleased to officially partner with Autochartist – one of the industry’s most reputable chart pattern recognition and analysis software companies, with a suite of products that enables traders, worldwide, to take advantage of market opportunities. Via this partnership, our clients and partners will be able to tap into the full potential that Autochartist’s toolset has to offer”, said Natallia Hunik, Global Head of Sales at Advanced Markets Group.

The CEO of Autochartist, Ilan Azbel said “The landscape for liquidity providers is quickly changing and I am delighted to partner with a company that’s adapting to this new environment. It shows forward thinking and innovation.”