ATFX Announces Cash Back Offer US$2,500 for Retail Traders

ATFX’s Cash Back offer was tailored to its retail clients’ trading habits, helping them save on each trade executed through their ATFX live account

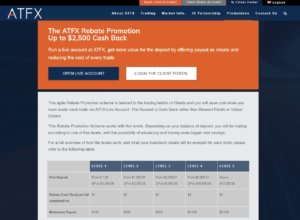

Leading global online trading services provider, ATFX announced the launch of the 2nd round promotion of Cash Back offer to their new and existing clients. The latest promotion offers clients Cash Back of up to US$2,500, based on completed trading lots. In the meanwhile, Welcome Credit of US$100 is also running now, it eases to the new clients to enter the financial markets. These incentive promotion are limited time offer.

Further details of this cash back offer are available on the company’s website

ATFX explained that the Cash Back offer was tailored to its retail clients’ trading habits, helping them save on each trade executed through their ATFX live account. This offer gives cash back not in terms of reward points or virtual currency, but in actual cash that clients can withdraw from their account.

ATFX has created a niche for itself due to its easy-to-use online trading platform, based on MetaTrader 4, as well as its client-focused support, which offers 24/5 localised help across multiple languages, so that clients can access support in the language they are most comfortable in. The ATFX platform allows trading across a variety of instruments, including forex, gold, oil, indices and CFDs.

The company also takes pride in offering low spreads and leverage of up to 400:1. Being a global platform, anyone wanting to participate in the financial markets can create a live account at any time and from anywhere, and with live support available across different time zones and languages, the company’s aim is to simplify the process of online trading for clients across all levels of experience.

The company also hosts regular training courses, seminars and workshops, while offering online educational resources to help traders strengthen their knowledge of the financial markets, so that they can make well-informed trading decisions that will benefit them. ATFX plans to launch more incentive programmes through 2018 to make online trading more rewarding for both new and existing clients.

About ATFX

ATFX was established with the aim of providing a robust online trading platform for retail traders interested in trading in forex, CFDs and precious metals. Today, the company, headed by an elite management team, has a global presence and offers a wide range of trading products.

To ensure a seamless trading experience, the company offers MetaTrader 4, the most popular trading platform in the world, while connecting MT4 with the top liquidity providers with the latest bridging technologies.

Due to its client-focus, ATFX also offers free access to market research, courses for all levels of trading, from novices to advanced levels, 24/5 live help and customer support, and highest level of protection for traders. With the security of funds of global investors as the top priority, security is ensured through bank-level security encryption, as well as ensuring that client funds are kept separate and protected at all times.

Legal: ATFX is a trading name of AT Global Markets Limited (ATGM, registration number 224226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : the Financial Services Centre, Stoney Ground, Kingstown, St.Vincent & the Grenadines.

All trading involves risk, losses can exceed your deposits.

*T&Cs apply.