Boost your brokerage business with these top 5 enduring investing trends.

By Kasia Flood

The online brokerage industry has witnessed rapid evolution throughout the past few years. Initially driven by financial regulation, digitization and the emergence of “fintech” market entrants, the pace has recently been hastened by new investor demographics and rising volatility.

Trading volumes increased drastically on March 11, 2020, after the World Health Organization declared COVID-19 a global pandemic causing prices to plunge and many markets to deploy circuit breakers. As the pandemic roared on, new accounts soared. At Trading Central, we experienced the increased demand firsthand. Usage for our embeddable research products climbed 22% from pre-pandemic levels following the WHO’s declaration and 49% at the height of the meme stock craze, where we quickly upgraded our server capacities to accommodate the growing needs of our customers.

Trading Central serves actionable analytics to over 100 million self-directed investors through the world’s most admired broker and wealth tech brands. Many of these partnerships span two decades, providing a unique vantage point on the digital wealth landscape. With every lasting “trend”, we see a unique opportunity for our brokerage customers to forge stronger investor relationships.

Here’s a look at key tips often shared by our teams of diligent customer success, user experience and marketing specialists:

1. Data transparency

Growing concerns of misinformation have increased rapidly, resulting in a craving for fact-based information. Addressing this demand can help establish trust with investors, as well as support contextual education and increase product engagement.

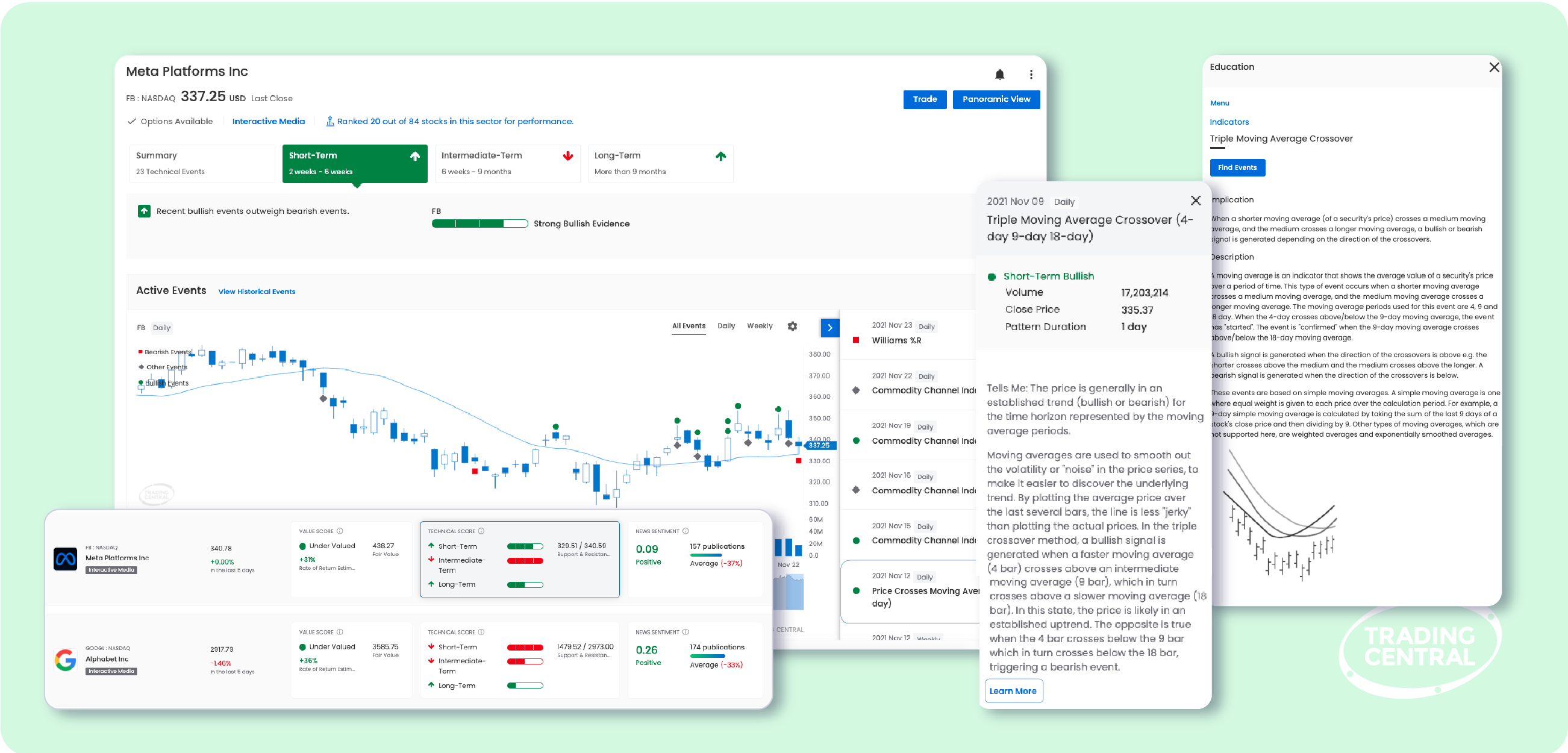

Provide a layered experience with all the interactive tools in your arsenal like “read more” links, tooltips and modals. This progressive disclosure of technical details ensures investors are never overwhelmed with excess information while continuing to address their desire for data.

In a recent product enhancement to link two frequently paired products, Trading Central saw exposing a single data point within the link increased the click-through rate by 58% compared to pre-release usage.

Within Trading Central’s Panoramic View and Technical Insight tools, investors can continuously drill deeper into the analysis beginning with high-level scores, all the way to data sources and educational support.

2. High-level Summaries

The overwhelming and continually increasing amount of unstructured data online is well documented. For investors, this informational bloat can easily create “analysis paralysis”, where varying perspectives, questionable sources and partial information can hamper timely decision making.

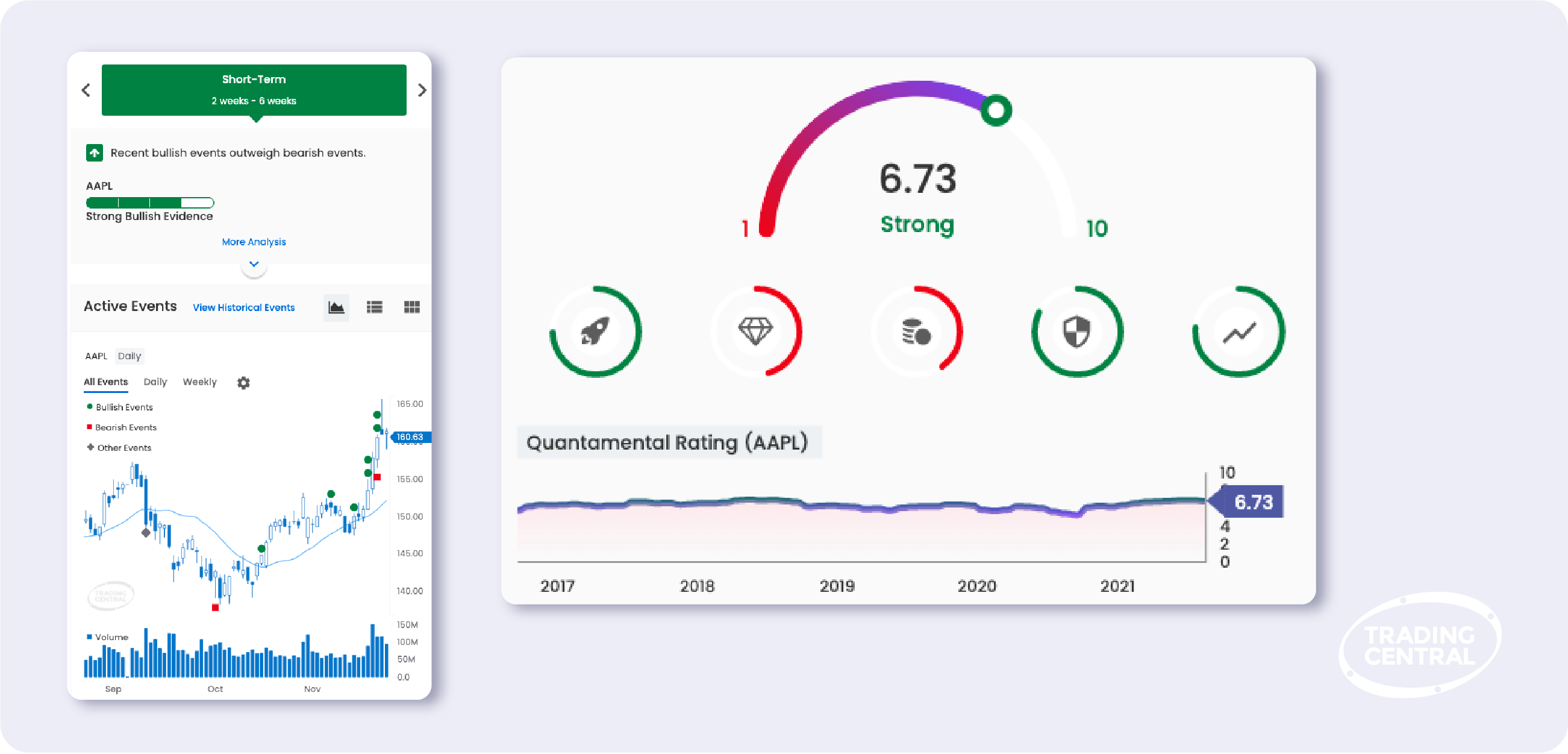

A popular aspect of Trading Central’s TC Quantamental Rating® and Technical Summary Score has been their ability to synthesize large amounts of complex financial information. At a glance, each tool provides investors with a high-level overview of everything they need to know based on the weight of evidence.

Many brokerages have seen success with implementing similar summaries directly within their portfolio holdings and stock lookup pages, providing concise and personalized insights.

The TC Quantamental Rating is a proprietary analytic which provides a concise, weighted average of 20 different financial metrics. The rating provides users with various investment styles a consistent framework for evaluating opportunities.

3. Expanding “news” sources

Public sentiment has a powerful influence on the markets, meaning today’s investors need to keep an eye on more than just traditional news sources. The importance of monitoring social media is exemplified by former US President Donald Trump’s preference for “tweeting” and Reddit users as the driving force behind the GameStop bubble. The emergence of more channels creates a two-pronged challenge for online brokerages: How to accommodate social media coverage and how to help investors interpret even more information.

Natural language processing provides promising opportunities to compress large amounts of news from a variety of sources and surface concise insights such as trending topics and whether the sentiment is positive, negative or neutral.

Trading Central’s TC Market Buzz is one tool offering this functionality and helps investors “read less, but know more” while enabling brokers to easily incorporate social media, web-harvested content and premium news feeds side-by-side.

4. Mobile-first

The financial industry as a whole has been late to adopt mobile, often thanks to legacy platforms and a lingering belief that it is simply an option for “on the go” investors. The latter is challenged by Trading Central’s product usage throughout the course of pandemic stay-at-home orders where investors saw an unprecedented reduction in mobility. Rather than decreasing as expected, the percentage of investors accessing research by app increased, contributing to the general surge.

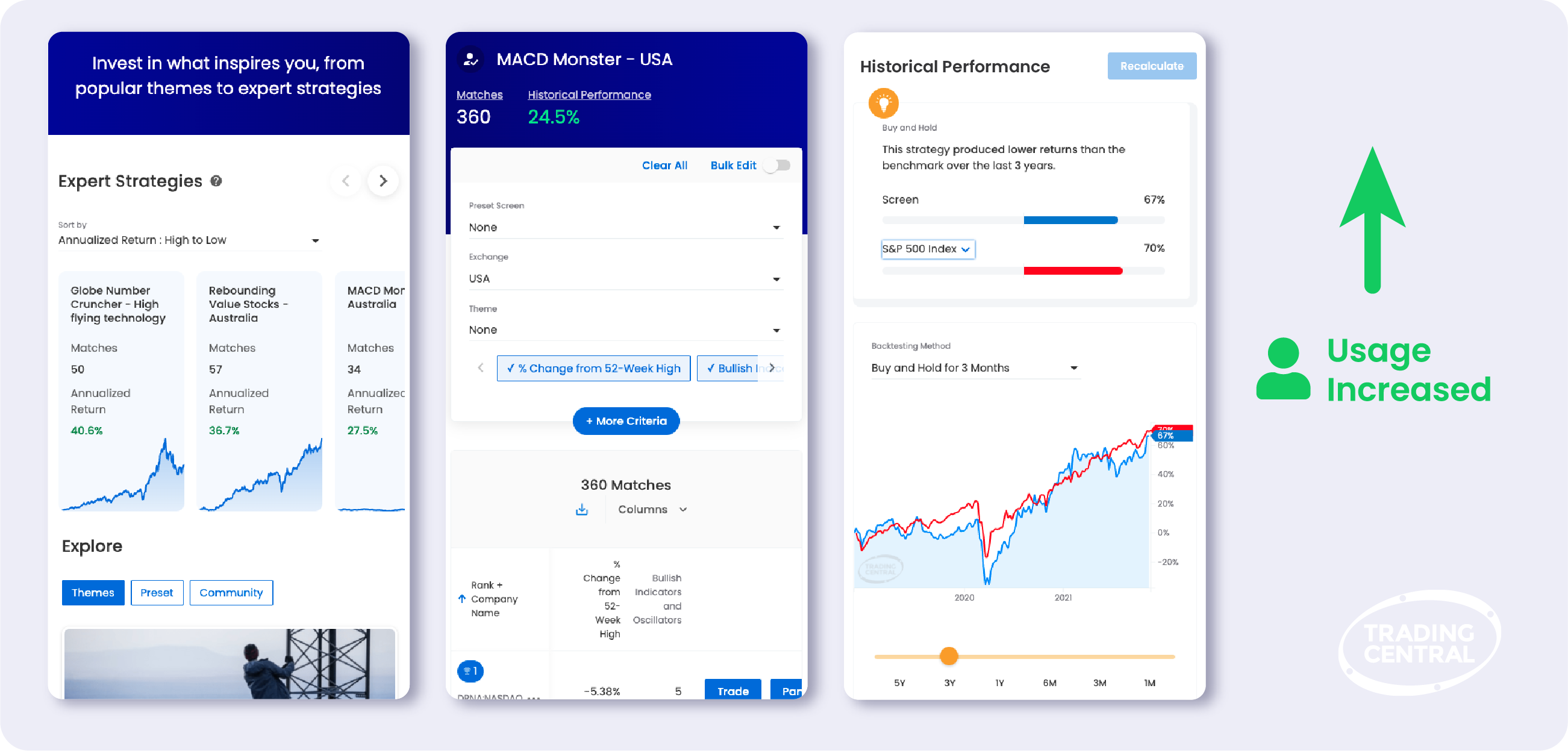

As Millennials and Gen Zers become more prominent investor personas, many brokers are experiencing growing demands for a wider range of functionality and interoperability across websites and apps. Brokerages depending on their web platform alone to deliver research and analysis risk lower engagement and loyalty with this audience. Prebuilt, mobile-ready embeddable solutions are a simple way to bypass heavy redesigns and match the growing demand quickly.

Despite wide-sweeping stay-at-home orders across the world, the ratio of mobile to desktop usage for Trading Central’s embedded solutions actually climbed in April 2020.

5. Gated research tools

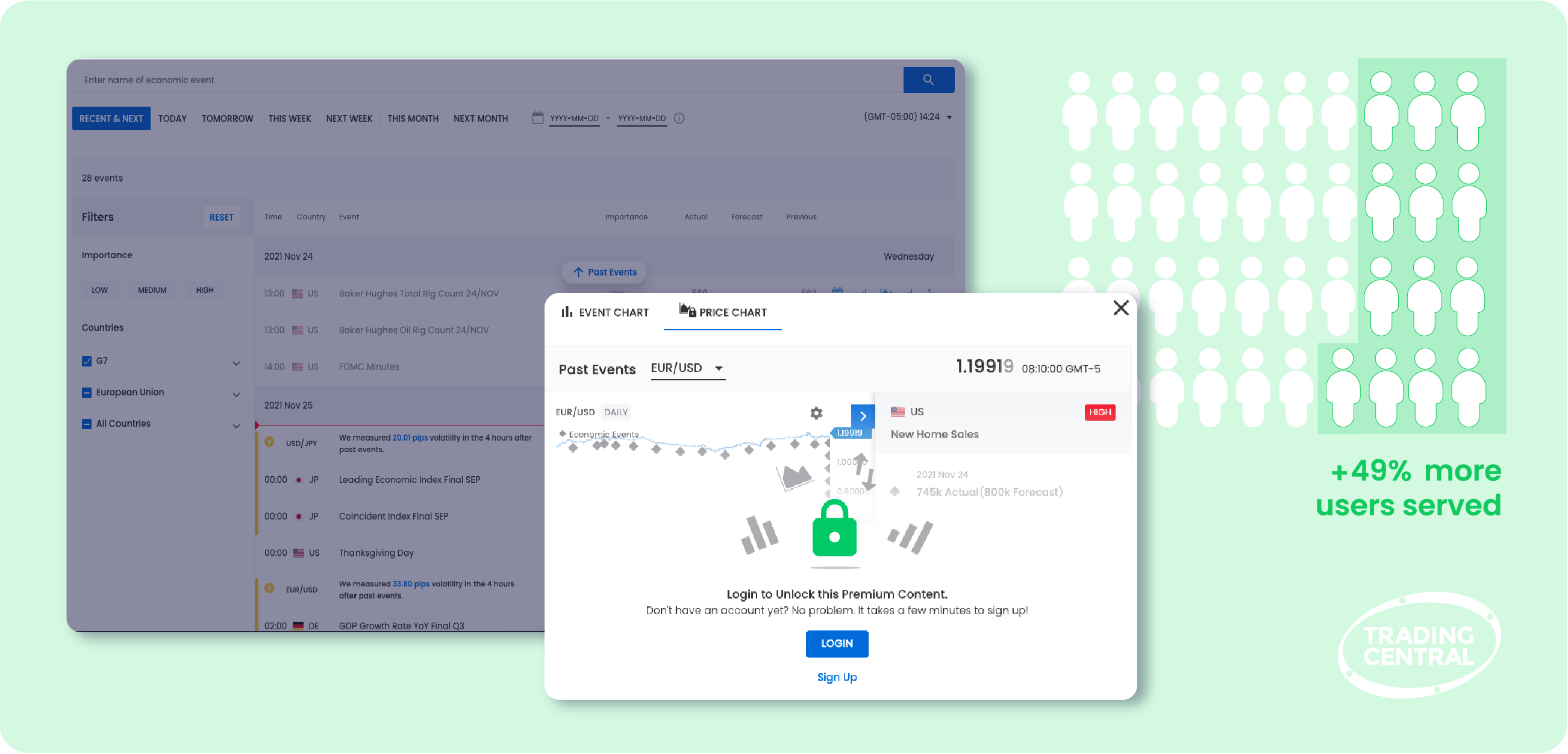

Internet scams, email spam, and data privacy concerns have made the general internet user wary of the countless signups online. Many don’t want to share their data or clutter their inbox for questionable value. For brokerages, this can leave many prospective investors on the sidelines, hesitant to create an account.

Placing semi-gated products within key areas of your public sites is a powerful way to lead with value, supporting higher conversion founded on trust. One brokerage using Trading Central’s embeddable freemium tools on their public site saw a 49% increase in product usage within a one month period.

“Freemium” versions of tools like Trading Central’s TC Economic Insight can help brokers reach new investors with quality features like an economic calendar, but prompt them to login for additional tools.

The past 20 months have ushered in a new era for the digital wealth industry. Is your business ready?

We feel strongly that investor loyalty is the result of immersive experiences that put them in control and provide the most successful results.

Get a free consultation on how to supercharge your platform today!