Celebrating 3 Years at the Heart of Financial Services Marketing – Guest Editorial

Contentworks Agency co-founder and FX industry marketing expert Charlotte Day looks back at three years of industry change, adaptability and shares perspectives on how to look forward to a good quality and streamlined marketing approach for the online trading industry in the coming years

By Charlotte Day at Contentworks Agency

International marketing company Contentworks Agency is turning 3! A lot has changed since the agency was established back in 2017, from financial regulations to marketing trends. But as the team toasts its progress, it’s important to reflect on the highs and lows too. In this exclusive, directors Charlotte and Niki reflect on life at the heart of financial services marketing.

A Rollercoaster of Events

The past few years have been a rollercoaster – exciting, turbulent, and nerve-wracking to say the least. But you don’t get involved in the finance sector thinking it’s going to be a lazy river ride. We love the challenge of this industry, so here’s a rundown of what’s cropped up over the past few years.

Regulation Updates:

- MIFID II

On 3 January 2018, Europe began implementing the sweeping financial regulations known as Markets in Financial Instruments Directive (MIFID) and Markets in Financial Instrument (MiFIR). Collectively, these reforms became known as MIFID II and the objective was to go after non-compliance more aggressively than the first turn of the documents during the financial crisis. Investor protection suddenly came under increased scrutiny and this very much affected our realm of business – content marketing.

To avoid a slap on the wrist, or something much worse, content marketing was required to:

- Disclose all facts

- Offer no recommendations

- Never make guarantees

- Avoid talking about specific investment products without including disclosure statements

For many firms generating content on a daily basis, this added another layer of complexity to their strategy. But we stepped in to help, using our compliance expertise and financial services knowledge to create content that met all MIFID II specifications.

Hiring a content marketing team that understood the rather lengthy rules was a must for many companies that were trying to operate their business as usually, while dealing with new and complicated regulatory frameworks. Our team also published articles to help brokers and other financial services firms inside and outside the EU make a smooth transition to MIFID II.

- Social Media Ad Bans

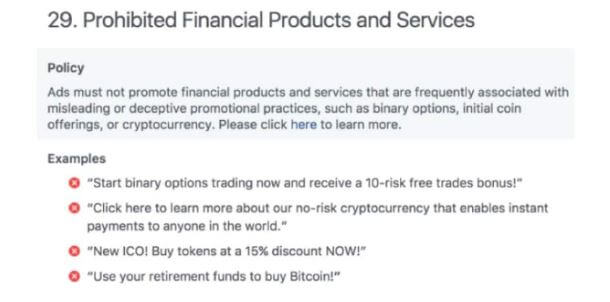

Anyone in the financial services marketing space knows that 2018 was a difficult year due to the sheer amount of change the industry faced. This was particularly true from a content marketing perspective with Facebook kicking off the social media ad ban in February 2018.

This meant that no marketer – even those operating on behalf of legal, legitimate businesses – could directly promote these subjects which were now viewed as ‘taboo’. And not only from Facebook’s core app, but also other places where Facebook sells ads such as Instagram and its ad network. YouTube and Twitter quickly followed suit banning ads relating to ICOS and token sales globally.

Such a clamp down impacted the marketing world once again with innovation needed to help brands stand out from the crowd. During this time, we came up with a wide array of ways to engage audiences and spread brand awareness, including:

- Storytelling – a great way to break away from promotional rhetoric and avoid using worlds related to banned topics such as cryptocurrencies, loans and forex.

- Video content – sharable video content and the use of Facebook Live, helped to improve authenticity and gain traction around a certain topic.

- Education – educational content that avoided banned buzzwords was also an excellent way for companies to stay relevant to their consumers. Thought-leading content posted to high-profile sites or business platforms like LinkedIn was, and still is, a good way to build credibility.

Facebook has since loosened its ban on ads related to blockchain and cryptocurrency technologies. In April 2019, a statement read: “We’ve listened to feedback and assessed the policy’s effectiveness. While we will still require people to apply to run ads promoting cryptocurrency, starting today, we will narrow this policy to no longer require pre-approval for ads related to blockchain technology, industry news, education or events related to cryptocurrency.”

This brings back Facebook ad opportunities and shows the importance of staying up to date with the latest news.

- GDPR

While grappling with MIFID II and social media ad bans, the General Data Protection Regulation (GDPR) also hit marketers hard. The EU initiative came into force on 25 May 2018 and addressed issues around personal data and consent. It was made clear that personal data must be processed in a lawful and transparent manner ensuring fairness towards the individuals whose personal data was being processed. Financial services companies were forced to improve their communication as they requested consent to use data from clients. Double opt-in became our word of choice and we generated highly desirable gated content to prompt more sign ups.

Changing Landscape:

During the lifespan of our agency, we’ve also seen other significant changes within the financial landscape. Leverage options have been tightened across the EU. Bonuses and money back schemes were banned (happily). There’s been an expansion of crypto offerings on forex platforms, and ICOs (which were particularly in focus during 2017 and 2018) have largely fizzled out due to connections with scams.

We adapted our focus and grew the agency from strength-to-strength, by:

- Using stats to drive our content marketing strategies

- Staying up to date with compliance rules and regulations

- Producing Regulation Roundups regarding cryptocurrency, blockchain and all things from the world of finance

- Focusing our energy on growing areas of business including challenger banks and the fintech space

- Producing compliance-focused content including e-books particularly targeted at marketing to specific demographics

Marketing Styles:

As well as regulation updates, marketing styles, tech and new trends have changed the way we work. On top of articles, whitepapers, e-books, social media and video, the focus for content marketers must now also be on:

- Personalisation. 80% of people claim they’ll work with a business that offers a personalised experience.

- Live videos on Facebook, Tiktok and Instagram. Live content keeps people watching 3x longer than recorded ones. The daily watch time for Facebook Live videos has quadrupled in a single year, and they produce six times as many interactions as traditional videos.

- SERP Position 0. Being number 1 is no longer the goal. The top spot on the search engine results page (SERP) is now position zero, a featured snipped of text which appears above the search results. Position zero is the first and sometimes only result that some users view. So, it’s of paramount important for businesses. Content that answers questions is often viewed as being most relevant for position 0 spots.

- Shoppable posts. Posting to social is one thing. Making your posts interactive and good for ROI means making the most of all available tools.

Contentworks Agency – The Highs

There’s been a lot to process over our 3 years in business, but it’s made us stronger than ever and we’ve got plenty of highs to look back on.

Some of our favourite highs include.

- iFXEXPO sponsorships – being part of such a world-renowned event certainly catapulted our agency to new heights. Director Charlotte also spoke on the marketing panel talking about the importance of content marketing in an increasingly AI driven world. Charlotte will also be speaking at this year’s event.

- Speaking on global panels – Contentworks has also media partnered other main events including Decentralized in Athens where the team again joined the marketing panel.

- Attending thought-provoking events – from the Cyprus Fintech Expo 3.0 in Nicosia to the Financial Innovation Forum in Limassol, we’ve learnt a lot from such innovative conferences and networking opportunities.

- Filming around the world –we’ve created standout video scripts for well-known clients such as NEC. This has seen the team travel around Europe and Asia.

- Working with a variety of clients – we are grateful to our clients who let us take the lead when it comes to creativity.

Where Are We Now?

2020 has been incredibly strange for everyone. We’ve responded by helping clients move online and embrace the digital side of their business. This has meant:

- Tightening website content to showcase offers, products and services

- Boosting the social media presence of brands

- Focusing on pre-recorded and live video content to convey messages

- Writing e-books, articles and blogs to keep consumers informed

- Adapting strategies to suit the current environment

- Partnering with reputable finance webinars like NPF and Virtual Vision Finance

- Providing thought leading articles and eBooks like the one below now available on slideshare.

Contentworks media partnered key webinar events including the Financial Innovation Crisis Management Webinar series which covered a wide range of topics including banking innovation during the Covid-19 pandemic. We’re all about keeping a positive mindset and doing everything we can to keep our clients thriving.

What’s next?

When the birthday excitement dies down and the last donut is eaten, we’ll be delving straight into our fourth year with a dynamic attitude. While the waters are somewhat murky due to coronavirus, it’s extremely clear that digital marketing is of paramount importance now and in the future. Therefore, we’ll continue working closely with our clients to ensure they’re represented online in the best way possible. As an agency, we focus on:

- Explainer content. With challenger banks, blockchain and forex all unearthing rather complex topics, we’re all about keeping explanations clear and simple.

- Humanising brands. Featuring CEOs and team leaders, telling your story and going behind the scenes are all ways to form a greater connection with audiences.

- Multi-pronged experiences. By focusing on multiple channels, brands can increase their outreach and build a wider and more loyal following.

- SEO. Digital marketing and SEO go hand in hand with the right keywords helping to bring products and services to the attention of interested parties. Also, position 0. Ranking for this is crucial and we can help brands achieve this.

- Modern CSR. Brands are now pushing into exciting sponsorship and CSR territories. We are keen to support this with authentic, meaningful content marketing.

Thank you to all our clients, colleagues, partners, and media outlets for your support. Join us as we journey into year 4 and take your finance brand to new heights.

Whether you need daily analysis, articles, education, social media management or video marketing, we can help. Find out more about our financial marketing solutions.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.