Charts of the Week: False breakout in the GER30; USOIL resumes downtrend

Prominent CFD and FX brokerage AxiTrader looks at insights from four analytical chart patterns that stood out this week

In this Guest Editorial, the management team at AxiTrader look at technical aspects of importance in retail trading, focusing on charting and analytic patterns during the course of this week.

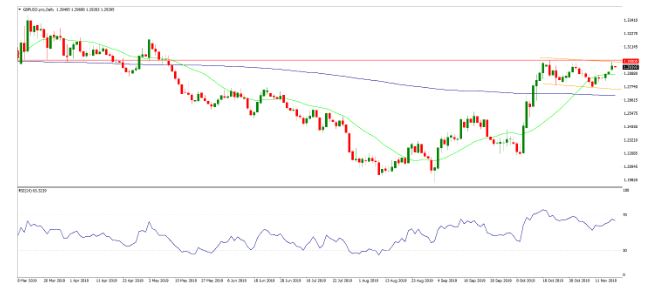

GBPUSD is trading within a descending channel, and is struggling to break above the psychological resistance level at 1.30. Price action has been relatively calm in the past few days, but volatility is likely to increase sharply ahead of the December UK General Election. To the topside, traders will be keeping a close eye on the 1.30 level, while support is noted at 1.2880 and 1.2750.

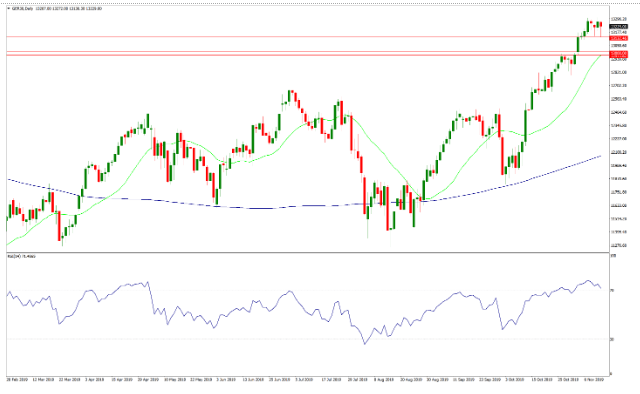

XAUUSD has recovered slightly amid renewed Dollar weakness, but demand remains rather weak as the mood in global markets is still positive. Key resistance is noted between $1475 and $1480, and a clear break above that area would help Gold bulls to regain the upper hand and pave the way for another rally towards $1500.

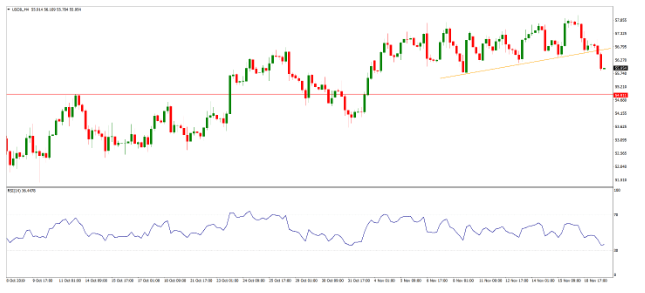

USOIL recently broke below the rising trendline from the November low, suggesting we could potentially see a test of $54.90-$55.00 support in the near-term. The commodity is still struggling to find a direction, but the overall downtrend remains intact.

The information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. Readers should seek their own advice. Reproduction or redistribution of this information is not permitted.