Charts of the Week: GER30 reversal; Aussie Dollar under increased pressure

GBPUSD is trending lower ahead of the official Brexit day – which is Friday, January 31st, say senior analysts at AxiTrader

The management team at AxiTrader takes a close look at the chart patterns that have defined this week’s trading.

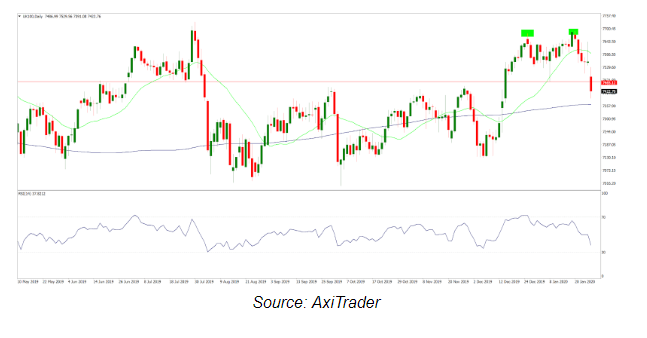

GER30 recently reached a new record high, but failed to sustain momentum as sentiment turned sour. Traders will be keeping a close eye on the rising trendline support from the mid-October low, followed by the psychological support level at 13,000 points. To the topside, bulls would need a clear break back above 13,350 points to regain the upper hand.

UK100 broke beneath a major support level at 7465 points, and is currently approaching the 200 DMA around 7360 points. A clear break below that line could signal a continuation of the reversal towards 7127 support.

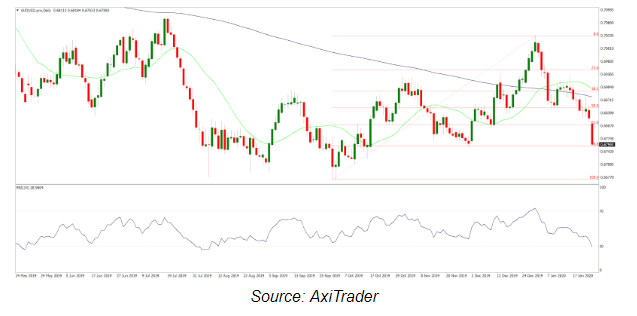

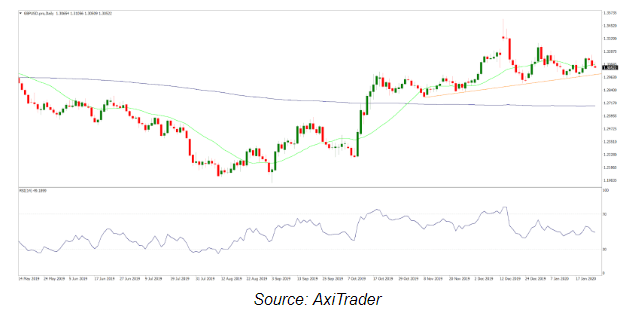

GBPUSD is trending lower ahead of the official Brexit day – which is Friday, January 31st. While the UK is certain to exit the EU on that day, plenty of uncertainties remain around the trade deal between the country and the Union, and this should keep volatility at elevated levels. Support is seen at the rising trendline from the November low, followed by the 200 DMA around 1.27.

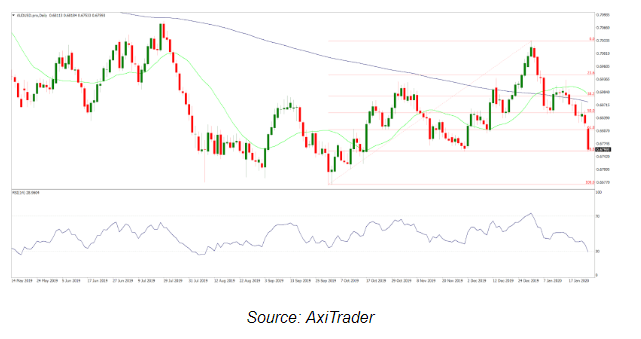

AUDUSD is suffering from the risk-off sentiment in global markets. The currency pair is currently testing the 76.8 % Fibo of the Oct-Dec 19 rally, and a clear break below could hint at a continuation of the downtrend, with 0.6680 the next significant support level.

The information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. Readers should seek their own advice. Reproduction or redistribution of this information is not permitted.

Find out more about AxiTrader here.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.