Charts of the Week: Gold and USOIL rally reverse + GER30 rebounds

In this guest editorial, AxiTrader’s senior management sets out four charts covering currencies and commodities that have shown movements in the market this week

The management team at AxiTrader takes a close look at the chart patterns that have defined this week’s trading.

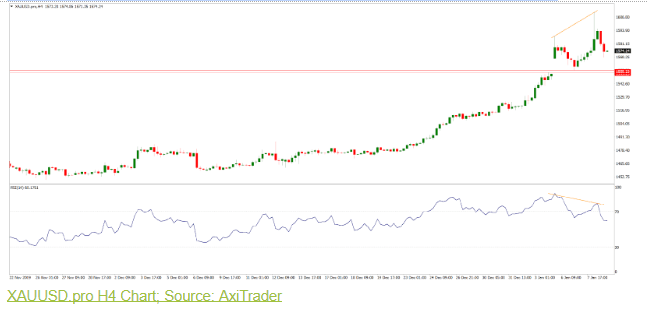

XAUUSD reversed recent gains, as risk appetite is slowly improving. The false breakout above $1600 and sharp reversal led to position covering from Gold bulls, and negative RSI divergence on the H4 chart suggests that the correction might not be over yet. Gold traders will keep a close eye on the support area between $1553 and $1555.

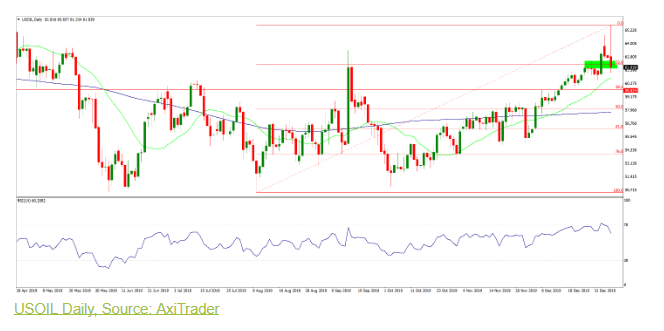

USOIL saw a sudden reversal as well, with pressure still increasing. Following the break below the $62 support level, traders will be looking at the area between $59.82 (38.2 % Fibo of the July 19-Jan 20 rally) and $60 level as potential area of support. The uptrend remains intact, but renewed geopolitical tensions will keep volatility at elevated levels, and traders should prepare for larger price swings.

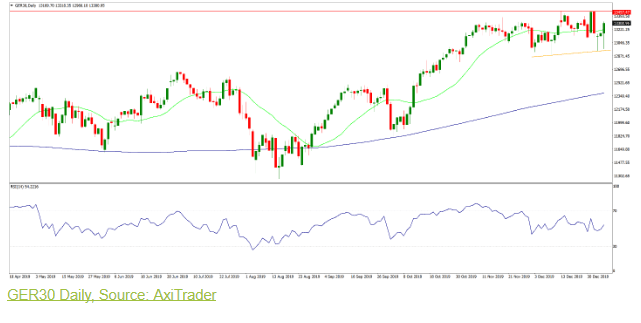

GER30 bounced off the rising trendline from the November low, and managed to clear the important resistance level at 13,200 points. Sentiment in global equity markets has turned positive, as investors see an escalation of the Iran crisis as unlikely. The next major resistance level to watch lies at 13,457 points, and DAX bulls already see the record high at 13,596 points as next target.

AUDUSD is trading within a rising channel, but was again rejected at the upper trendline. The currency pair has also broken below the 21 and 200 DMA, while the RSI is not signaling oversold conditions yet. This may suggest that the Aussie Dollar could see further losses in the near-term. Support is seen at the lower trendline, followed by 0.6780.

Find out more at AxiTrader here.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.