Devexa Chatbot Integrated with Salesforce to Automate FX Brokers Customer Support

Clients can check their application status while going through KYC and AML procedures, check their withdrawals and interact with CRM data directly via the digital assistant, omitting the broker’s support desk

Many retail stock and FX brokers use Salesforce as their CRM to manage their client base. Many of them have tried to employ chatbots integrated with SF, but those chatbots lacked intelligence. Instead, the brokers needed a digital assistant that would be able to derive the necessary information from the CRM & trading platform’s data and send it to the client to take the burden off the support desk.

Devexa is now able to interact with SF data and represent a broker’s support & sales desks in any messenger that has a chatbot API. Users can be onboarded, converted into real clients and served in Facebook, Viber, and Telegram.

Functionality that Automates and Speeds Up Onboarding

It is a common case that users want to be onboarded as fast as possible and to have immediate access to a trading platform. On the broker’s side, it often requires some time – from several hours to even several days. As the traders usually want to start trading within the moment, they keep asking the broker’s support desk on the status of their approval.

For the help desk personnel, it might take several minutes to find out the answer – find out the client’s details, open to the Salesforce app, distract the info from the client’s profile, and come back to the client with the update on his status – all that the chatbot could fetch from the SF instantly. Making the clients wait, unaware of the status of their application, can lead to poor customer satisfaction.

Below are three examples of how automation can be used to lighten the workload placed on brokers’ customer service desk.

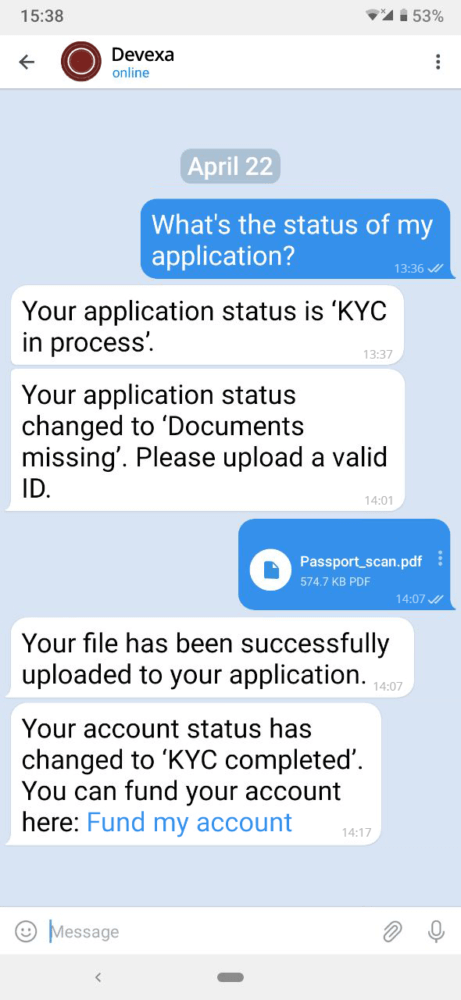

1. Check Account Status On-Demand

Clients can check their application status (while going through KYC and AML procedures) directly via the digital assistant, omitting the broker’s support desk. For example, the client would be able to see if there are any necessary steps or documents they’ve skipped in the sign-up process.Check Account Status On-Demand Clients can check their application status (while going through KYC and AML procedures) directly via the digital assistant, omitting the broker’s support desk. For example, the client would be able to see if there are any necessary steps or documents they’ve skipped in the sign-up process.

2. Push Update on Account Status

Devexa can send notifications about a status change to the client in the form of a push notification. For example, the user can receive a push notification that their photo or scanned document was not accepted (e.g. if the photo was blurred or distorted).

3. Upload of Documents

Users can upload documents such as their ID or proof of residence via Devexa (if such use of messengers is permitted by a respective regulatory body). They send the missing/pending documents, which will be uploaded straight to the client’s profile in Salesforce and associated with the lead from Devexa’s dialogue.

Deposits/Withdrawals

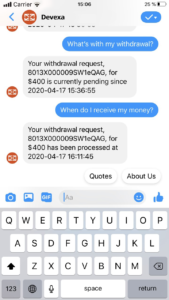

Devexa not only works with Leads and Accounts entities in Salesforce, but it can also track deposits/withdrawals.

One of the most frequent requests a broker’s support officer receives is to check the status of a withdrawal. Other chatbots can only answer with canned responses about how much time it usually takes to process a withdrawal request.

Devexa can deliver the information from Salesforce that can be disclosed to clients and craft a personalized response depending on the actual status.

Examples:

U: What’s with my withdrawal?

D: Your withdrawal request for 400$ is currently pending since 2020-04-17 15:36:55

U: When do I receive my money?

D: Your withdrawal request for 400$ has been processed at 2020-04-17 16:11:45

Request a demo here

Contact:

Devexperts

Alex Kariagin, CMO

[email protected]

+49 (89 26) 20 77 352