The FinanceFeeds Sydney Cup: Australia goes from strength to strength

As Australia continues to demonstrate absolute professionalism in its leadership in the FX industry, here are the highlights of the FinanceFeeds Sydney Cup event on Thursday, November 22, 2018

On Thursday, November 22, at The Establishment in Sydney, Australia, FinanceFeeds hosted the Sydney Cup FX Industry Networking Event, representing the 16th event in the Cup series, and the fifth to be held in Sydney, Australia.

It has become widely recognized that Australia has become a global benchmark for the entire retail FX industry, its brokerages being held in high esteem among retail customers and institutional partners alike, hence Thursday’s attendees represented some of the largest and most widely acclaimed companies from across the world.

Senior executives from institutional liquidity companies, prime brokerages, banks, platform development companies and regulatory reporting entities from London, Singapore, China, Hong Kong, Melbourne and of course Sydney itself met to discuss important aspects that are currently driving the business forward, and as has been the case for many years in Australia, with tremendous enthusiasm.

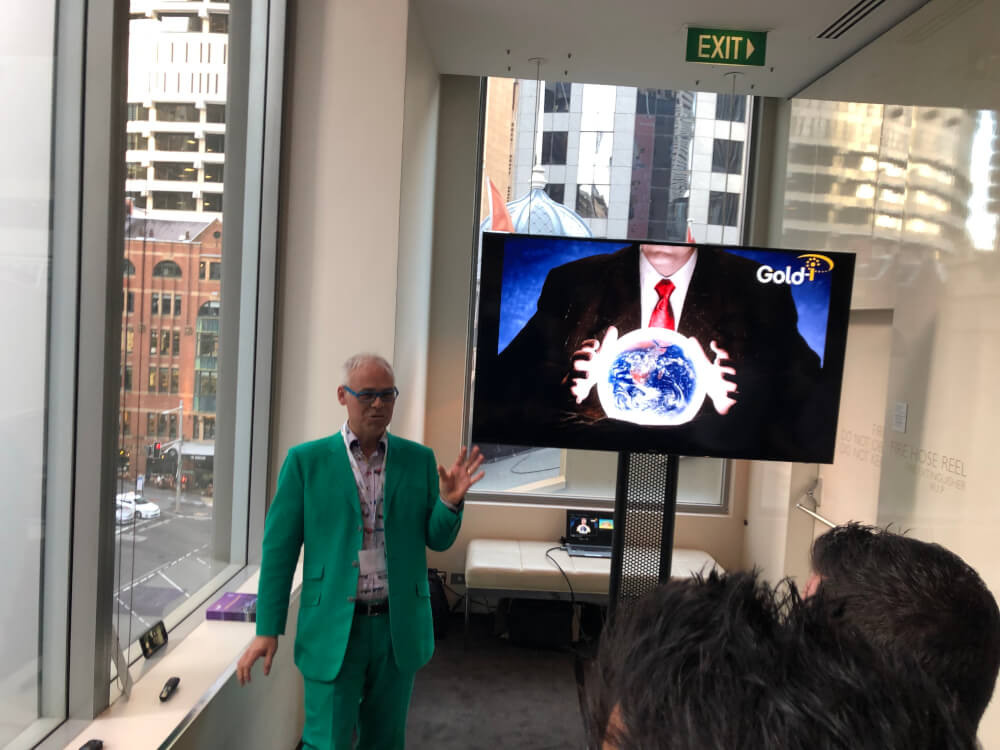

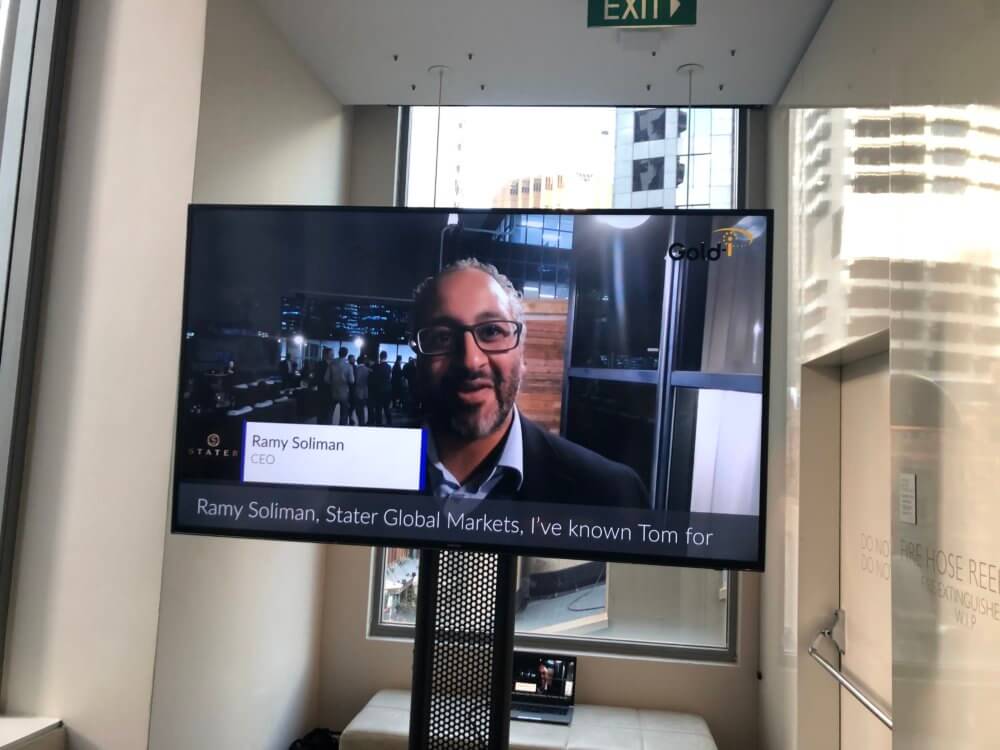

Sponsored by Gold-i, a mainstay of financial technological development and platform integration for retail brokerages, the company’s CEO Tom Higgins went into insightful detail on his view of the electronic financial services sector over the next ten years, tying in nicely with his recent celebration of Gold-i’s tenth year since establishment.

Here is a full montage of the evening’s event, and we look forward to hosting you all again at the next Sydney Cup in February 2019, with details to follow very soon.