Financial Content Marketing for Millennials – Guest Editorial

“Millennials are also highly impatient with 35% willing to jump ship and seek out competitors if a mobile banking process takes too long. Millennials also have a very short attention span of around 8 seconds and require more from a company than just self-aggrandising content” – Charlotte Day, Contentworks

By Charlotte Day, Contentworks

Millennials are Digital Natives in the sense that they’ve grown up with technology. They’re highly connected with 95% owning a smartphone and 85% hooked up to social media. And consumers within this category are 2.5x more likely to be an early adopter of new tech trends than other generations. So, what does this mean for fintech brands and how are marketing agencies like Contentworks setting the pace?

The Pros and Cons of Millennial-Based Marketing

Well, at a glance it’s good news. Fintech companies and financial services brands embracing innovative tech have an audience ready and waiting. Millennials love new and exciting things, they’re online and appreciate problem-solving initiatives. So far, so good. But there are challenges. Millennials are also highly impatient with 35% willing to jump ship and seek out competitors if a mobile banking process takes too long. Millennials also have a very short attention span of around 8 seconds and require more from a company than just self-aggrandising content.

So, what’s the ultimate content marketing plan for this hard-to-please consumer?

#Optimise Content for Mobile

Google has a mobile-first index. This means a website’s mobile form is used for ranking purposes as opposed to its desktop counterpart. With this in mind, you should already be optimising your content for mobile use regardless of your target audience.

But it’s even more important when you consider how Millennials approach financial services, with 47% using their smartphone for mobile banking. The reality is, if your content isn’t suitable for mobile devices, your bounce rates will be high, and you’ll lose crucial leads. On a similar note, around 2 billion people around the world will be using a fintech app by 2020 which is why deeply exploring the mobile space is important. That may also mean having your own app!

#Don’t Overcomplicate Content

Millennials like creative, high-tech and adventurous ideas. But they don’t like over complicated content. Or waffle. Or banner ads. Or content that’s too promotional. So, whether you’re promoting a financial services app or need content for your website, keep it simple.

Contact Contentworks today for tailored financial services content that works.

Here are some examples of clear, concise app content.

- Robinhood

An investment company with a high millennial following, Robinhood produces short, sharp content that hits the nail on the head. This appeals to Millennials who are used to receiving the right information when they need it the most. They also need clear direction.

Takeaways: Use bold headings and create bitesize content that can be easily nibbled. Offer product highlights as well as an option to find out more if they want to. Being clear and concise helps to avoid infobesity. This is where you bombard someone with so much content that they feel too overwhelmed to make any kind of informed decision. It can negatively impact ROI.

- JPMorgan Chase

JPMorgan Chase set up an online banking app by the name of Finn. Aimed at Millennials it was designed to extend outreach and attract new audiences in areas where the bank didn’t have a physical branch! The easy-to-read, clearly presented and to-the-point content is very much appropriate for Millennials.

Top takeaways: Use proactive language to encourage and persuade. Calls to action include the above trigger words such as ‘get,’ ‘set up,’ ‘send,’ ‘find’ and so on.

#Know Your Audience

How can you successfully market financial products unless you know you audience? Gaining relevant insights into a particular consumer base allows you to be much more creative with your content. For example, did you know that:

- 2/3 Millennials want digital budgeting tools

This fact alone should prompt you to not only step up the tech side of your business, but to promote any digital budgeting tools effectively through articles, blogs, video and such to garner followers. And, if tools are still in the development stage, it doesn’t mean you can’t blog about them or create shareable infographics. Effective content marketing means thinking outside the box and finding ways to engage with your audience based on their preferences and wants.

- Only 28% of Millennials have a solid understanding of how to invest their money

This is gold dust for investment firms in many ways as it opens up a new marketing avenue. If you offer investment services, this is the perfect opportunity to provide how-to guides and revise your product information. Explainer videos and tutorials are also a great way to educate people about your brand and services. Remember, millennials don’t like hassle. So, keep everything straightforward and make all steps as easy as possible.

The majority of Facebook videos are watched without sound also, so providing text alongside visual content is a must.

- Millennials are 5x less likely to visit a brick-and-mortar bank than older generations

With this in mind, how can you match the quality of face-to-face customer care? Well, how about embracing the chatbot trend which is sweeping the digital world?

Chatbots are effective for many reasons. On one side of the coin chatbots can really help to engage an audience that may otherwise lose interest without being stimulated to engage. On the other side, they help businesses to be more responsive and convert leads. After all:

- 24% organisations take longer than 24-hours to respond

- 23% companies don’t respond to queries at all

#Be Present and Active on Social Media

When it comes to financial services. Authenticity is essential. This is particularly crucial in a sector that’s often plagued with malpractices such as exchange hacks and scams.

One of the best ways to prove yourself as a genuine brand is to humanize your company on social media. Developing a loyal following doesn’t happen overnight, but you can help build trust among consumers by:

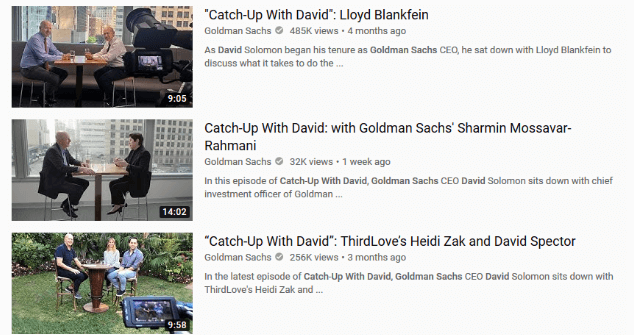

- Posting videos of management

Goldman Sachs put a face to their brand by featuring CEO David Solomon in a video series that’s widely publicized across multiple social channels. As you can see below, the YouTube videos alone gain thousands of views which in turn helps to increase brand awareness.

Top Takeaways: Create a video series featuring key members of the team. This is a great way to generate regular, organic content that people can come to know and look out for. It’s also important to use branded or relevant hashtags where appropriate to ensure your posts can be found easily. Keep your hashtags short and sweet to make sure they’re legible.

- Sharing reviews and company highlights

8/10 millennials never buy anything without reading a review first. 3/10 will only buy from sites with trusted recommendations also. Therefore, if you receive a positive review or are mentioned in the media in a way that showcases your brand well – talk about it! Sharing comments or re-tweeting positive sentiment is much more appreciated by the millennial market that generic 5-star reviews which are often not trusted these days.

Remember, fake news is big news for all the wrong reasons. There has been massive publicity about in in recent years causing millennials to think twice about what they read. Therefore, promoting testimonials and reviews that come from a genuine and reputable source is key.

Top takeaway: Be on the ball and monitor your online reputation. Keep an eye on how you’re being represented in the sector as there may be a whole wealth of organic material you can share from consumers as well as top companies like Forbes.

- Think About Corporate Responsibility

Home and renter’s insurance company Lemonade is also good at embracing corporate responsibility. This is significant considering 37% of millennials say they are willing to purchase a product or service to support a cause they believe in, even if it means paying a bit more.

This consumer group is more environmentally aware and are interested in companies that aim to help the wider community. By sharing corporate efforts which better society, you can simultaneously boost your reputation. The catch? You must be genuine! Support projects that match the morals and ethics of your brand.

As literacy fans and content marketing experts, Contentworks teamed up with non-profit organisation Room to Read to support education rights for children across the globe. Interestingly, corporate responsibility is being taken more seriously now than ever before perhaps due to the changing demands of younger consumers. BlackRock’s CEO Larry Fink wrote an open letter explaining how if companies wanted to continue receiving support, social responsibility had to become a top priority on their to-do list.

Content marketing for millennials can be highly persuasive if done properly. Contact the team at Contentworks today for financial services content that your audience can’t get enough of.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.