Former Dukascopy CEO Alain Broyon majors on revitalizing wealth management space with 3D marketplace

New service provides virtual meeting place for global, always-on interaction with investors and wealth managers

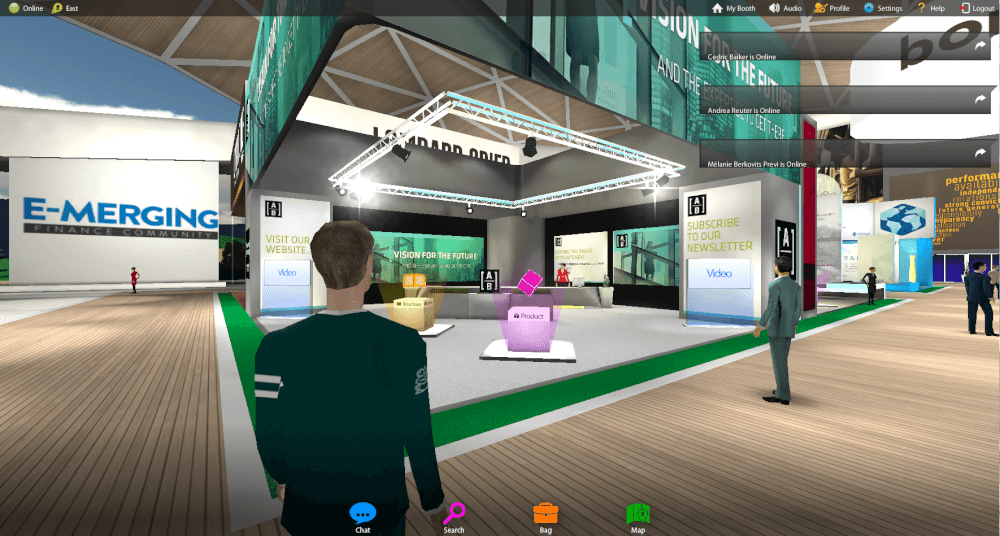

Planet of finance, a large online community dedicated to the wealth management industry, has announced the launch of Planet of finance 3D, a unique virtual marketplace connecting wealth managers with investors and peers.

For investors, it’s a powerful free tool to connect with wealth managers and financial advisors 24/7. Investors can approach and speak with any registered wealth manager, seeking the insights they need to make smart choices on how to look after their money. The permanent marketplace has already attracted some of the biggest industry names including: Bordier & Cie, CFM Indosuez Wealth Management, IG-Bank, IRISOS SA, Lombard Odier, Notz Stucki and Union Bancaire Privée, all of which investors will get direct access to from 3rd April.

For wealth managers, Planet of finance 3D slashes the cost of customer acquisition. Wealth managers can design virtual booths with customisable messaging to attract prospective investors. They can then share videos, brochures and business cards and answer queries from potential prospects via chat or Skype calls. Planet of finance 3D also allows professionals, to connect with peers in order to find business partners, expansion opportunities and more.

Both investors and professionals will also benefit from regular digital events dealing with the main themes and trends in investment and the wealth management industry. Planet of finance 3D will be running a core event programme for private individuals and professionals on different topics such as robo-advice, crowdfunding, technology and asset allocation. Banks and exhibitors will also be able to host their own events and broadcast live videos from the auditorium.

Antonio Mira, Group CFO at Notz Stucki commented, “Planet of finance 3D offers a real opportunity to explore new ways to connect with prospects and peers at any time. We see this platform helping us to attract younger, tech-savvy clients who have not previously had the time or passion to explore wealth management options. The 3D marketplace will also allow us to build relationships and share solutions with other finance professionals.”

Olivier Collombin, Planet of finance founder said, “3D is another step in realising our mission of democratising wealth management by making it easier for individuals and professionals to meet. The launch of 3D builds on the success of previous virtual events we have hosted. And now, for the first time, the wealth management industry has access to a permanent virtual marketplace.

We are excited to have a number of the leading global wealth managers already on board, alongside private investors.”

Alain Broyon, Planet of finance partner said, “ The aim of Planet of finance is to simplify access to wealth management, empowering people with the use of digital innovation. Providing this technology to the wealth management industry will allow professionals to organize their own virtual event, thus making this permanent marketplace the most dynamic place to exchange with new investors”.