FP Markets launches new Client Portal and MT5

FP Markets launches market-leading Client Portal and adds multi-asset platform MT5.

FP Markets, an ASIC-regulated global CFD and Forex broker with over 13 years in the industry, enhances its clients’ user experience with the launch of its bespoke secure client portal. In addition, it has added the multi-asset platform, Metatrader 5 (MT5), to its wide-ranging offering of existing platforms which includes Metatrader 4 (MT4) and IRESS.

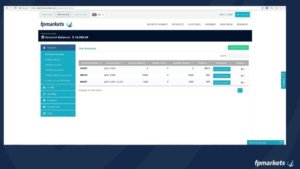

The new Client Portal uses advanced technology and a secure client interface to facilitate the customer engagement experience and speed of interaction when trading with FP Markets. Some of the bespoke features of the new client portal include:

Quick onboarding process (less than five minutes to complete), with clients able to upload documents from the portal and track their progress. Electronic verification means clients can be accepted instantly and start trading.

Easy creation of additional accounts within the client portal. Availability of MT4, MT5 and the IRESS platform and multiple account types (RAW and Standard).

Instant functionality including deposits, internal transfer between accounts, leverage changes (up to 500:1) and reset of trading passwords.

Ability to run reports on all trading accounts and cash activity which can be exported to excel at the touch of a button.

Access to live chat support, FAQ and other online trading resources plus track your trades and monitor your positions through a secure client interface.

In tandem, FP Markets has added multi-asset platform MT5 which offers superior tools for comprehensive price analysis, use of algorithmic trading applications (trading robots/EAs), copy trading and is the evolution of MT4 which is already regarded as the go-to platform for traders globally and is designed to give traders an advantage, taking the trading experience to a whole new level.

In tandem, FP Markets has added multi-asset platform MT5 which offers superior tools for comprehensive price analysis, use of algorithmic trading applications (trading robots/EAs), copy trading and is the evolution of MT4 which is already regarded as the go-to platform for traders globally and is designed to give traders an advantage, taking the trading experience to a whole new level.

Craig Allison, Head of Global Development at FP Markets, commented,

“We are delighted with our new bespoke Client Portal which will empower our clients’ user experience. We considered the tasks and functionality that would offer our clients faster, more secure access and allow them to trade at greater speed and capacity. At FP Markets, we have a history of investing heavily in technology and our clients can be confident that FP Markets’ technology offering is unmatched in the market.”

FP Markets offers over 10,000 trading instruments across Forex, Equity CFDs, Indices, Futures CFDs and Bitcoin, making it one of the largest offerings in the industry and the convenience of being able to trade CFDs from the one account is why so many traders are opting to trade with FP Markets.