Invast Global Launches New Cash Oil & Index CFDs

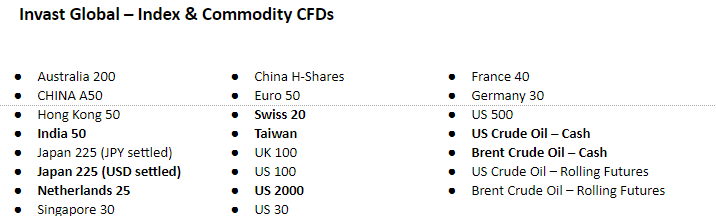

Prime of Prime brokerage Invast Global has responded to the high level of demand for access to new products and asset classes this year by adding two new Cash Oil CFDs and six new Equity Index CFDs to its multi-asset product range

Multi-asset prime broker Invast Global is pleased to announce the expansion of their suite of Index & Commodity CFDs by releasing two new Cash Oil CFDs; Brent Crude Oil (Cash) and WTI Crude Oil (Cash) as well as 6 new Equity Index CFDs; Japan 225 (USD settled), US 2000, Netherlands 25, Swiss 20, India 50 and the Taiwan Index.

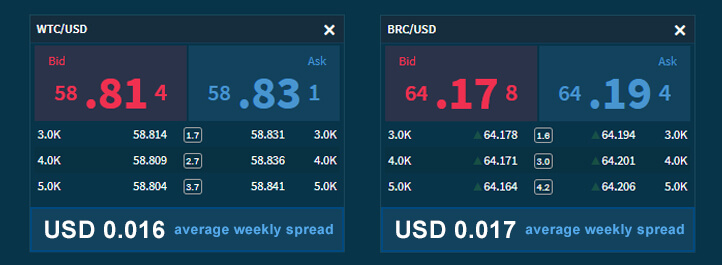

Average spreads over the past 2 weeks have been very consistent, with WTI Crude Oil (WTC/USD) at USD 0.016 and Brent Crude Oil (BRC/USD) at USD 0.017.

Invast Global has been growing quickly in 2019 with multiple new offerings across a range of asset classes this year, with more product releases scheduled for 2020. According to Invast Global, the expansion of their offering highlights a shift they have seen from their global broker client base.

“It is no secret that FX volumes have been impacted significantly across the industry this year. As a result, we are seeing enormous demand for access to new products and asset classes from our broker clients, to diversify their revenue and have an edge over their competitors.” – James Alexander, Chief Commercial Officer

To find out more about Invast Global’s multi-asset liquidity, please click here.

Featured Image: FinanceFeeds CEO Andrew Saks-McLeod with Invast COO James Alexander at the company’s head office in Sydney, Australia