Launch of Snap IPO Grey Market

IG, a global leader in online trading, today launches a grey market for the Snap IPO. IG offers grey markets in advance of the listings of companies on stock markets in the UK, Europe and the US. It allows traders to speculate on the direction of a share price or market value of a company, […]

IG, a global leader in online trading, today launches a grey market for the Snap IPO.

IG offers grey markets in advance of the listings of companies on stock markets in the UK, Europe and the US. It allows traders to speculate on the direction of a share price or market value of a company, before its shares become completely listed.

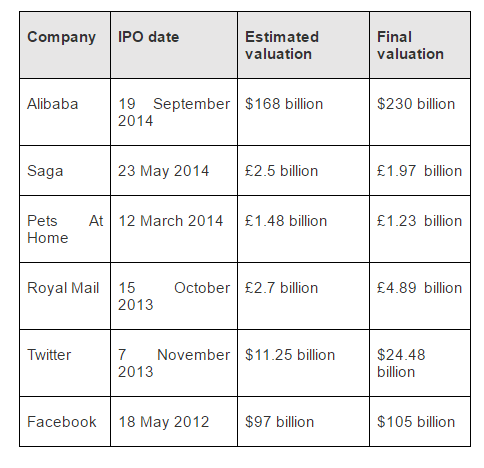

Traders have enjoyed the opportunity to speculate on the valuation of a company before it becomes public traded. Previous grey markets such as Royal Mail and Facebook were particularly popular among IG clients, given their major presence in daily life.

The current price in the market estimated the value of Snap to be $27.9 billion.

Chris Beauchamp, Chief Market Analyst, comments: “Historically IG’s grey markets have been solid indicators of where companies official launch prices will end up. Snap is one of the biggest and most anticipated US tech IPOs for years, with the potential to rival the excitement witnessed when Facebook and Twitter went public. The echoes of Twitter’s IPO are clear to see, given Snap’s admission that turning a profit could be difficult. Whether the IPO hype survives once the initial celebrations are over remains to be seen.