Marketing To Millennials In The Finance Sector

Charlotte Day of Contentworks goes into detail about how to approach the all important Millennial generation with marketing that succeed, giving examples of successful campaigns from major financial and FinTech firms

By Charlotte Day of Contentworks

Marketing in any industry is hard and the finance sector has a particularly tough time due to tight regulations. Marketing to millennials in the finance sector adds another layer of complexity, because this generation has a lot going on. Not only are millennials dubbed the pickiest generation but they also have a digital-first orientation and were hit hard by the financial crisis which left them shouldering poor job prospects and heavy debt.

This generation has the most debt which has increased by 22% in just five years and currently stands at around $1 trillion.

Consequently, 45% of millennials are wary of traditional financial services. So how do you go about marketing to a generation that’s at odds with the finance sector but still perceives economic security as one of the main milestones to becoming an adult?

The solution lies in recognising and acting on millennials’ financial needs. Here’s three ways to tap into the millennial mindset and acquire this generation as customers.

1: Focus on the lifestyle your products can offer

Millennials are conservative when it comes to their money and financial products. In fact, 67% of them don’t hold credit cards and many don’t consider money as the sole marker of success. This doesn’t mean that millennials don’t use credit cards and other financial products at all. They do, but unlike previous generations, millennials do things differently.

Many millennials saw their parents lose their savings during the financial crisis and so they now want to seize the moment instead of worrying about owning things.

For instance, only 38% of millennials see buying a home as a good investment and the number who think buying a house is better than renting has decreased by 22% to 61% in three years. While previous generations are happy with marketing campaigns that promote owning things, millennials want campaigns that offer innovative products and services which provide opportunities for memorable experiences.

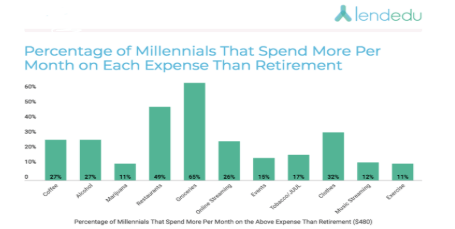

You need to shift marketing focus to the lifestyle that millennials crave. 65% of millennials are saving for travelling and 49% spend more on eating out than they do on retirement savings.

Financial campaigns need to redirect focus from the products or services on offer to the lifestyle those products can offer. Even traditional banks like Barclays are using this strategy in their marketing campaigns to attract millennial customers.

Get financial services marketing solutions for your bank or broker

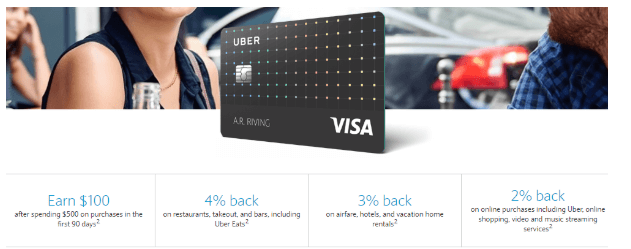

Barclays has the popular Uber Visa Card which pays some of the highest rewards on food. Instead of promoting the card directly, Barclays gets millennials’ attention with the zero annual and foreign transaction fees, and money back on things millennials enjoy like dining, online purchases, music streaming services, airfare and hotels.

Top Marketing Tip

Focus on what you can control – how millennials interact with your products and brand. For instance, 8/10 millennials are willing to switch banks for better rewards. So, instead of mundane sales messages, offer incentives.

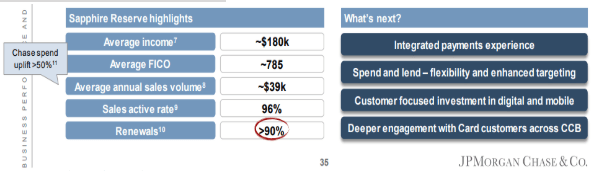

The Chase Sapphire Reserve card marketing campaign was a big hit with millennials because its focus was on promoting travel, something that millennials enjoy.

Currently, millennials are the generation that travels the most and although the card has a relatively steep $450 annual fee, the loyalty benefits and travel rewards members received were appealing. The millennial-centric campaign paid off and JP Morgan reported a customer retention rate of over 90%

2: Connect on a personal level

No generation is stagnant and as millennials progress with their lives, their financial needs evolve as well. A quick way to fail at millennial marketing is to assume that all millennials have the same needs.

On average, first-time homebuyers are 34, first-time mothers are 30, and recent college graduates are 23. This means older millennials are probably getting married, starting families, and looking to own homes while younger millennials are likely more focused on clearing student debt and getting jobs. Selling an irrelevant product or service to millennials who are not experiencing a certain milestone will result in ineffective campaigns.

Personalising millennials’ financial experiences to correlate with where they are in life is a good way to market. Millennials don’t like ads, especially financial ones, but 67% of them are willing to engage with personalised financial ads that help them attain their financial goals.

Successful marketing to millennials in the finance sector hinges on the ability to anticipate needs and tailoring campaigns accordingly.

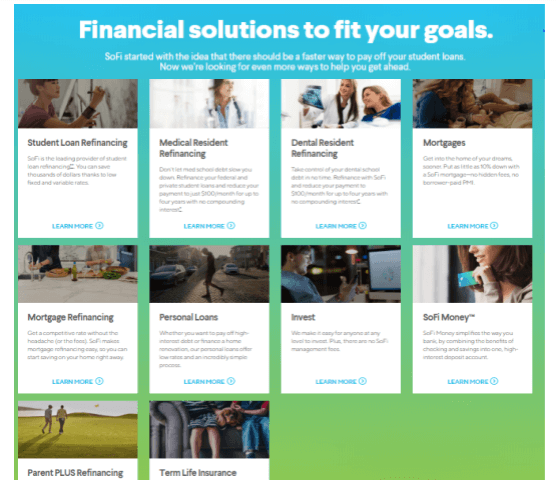

Fintech company SoFi has successfully appealed to the various millennial groups and continues to show the power of anticipating and catering to the needs of millennials at different life stages.

When SoFi started, it focused on student loan refinancing but it has since expanded. Instead of focusing solely on the student loan aspect, SoFi now offers services that cover the different stages of a millennial’s life including mortgages, insurance, and wealth management services.

The company has distinguished itself further by offering non-banking services including networking opportunities and career coaching for recent graduates who also make up part of the millennial population.

Top Marketing Tips

Market to the emotional and practical needs of millennials. For example, when targeting those buying a new home, think about what worries or concerns they may have and be a go-to source of knowledge. You can do this by writing articles such as “5 New Homeowner Hacks”, creating funny GIFS or posting polls to help them connect with like-minded people going through similar things.

You need to provide comprehensive solutions for millennials. 67% of millennials who want to own a home have to save for 20 years and 33% have to take up a second job to speed up the process.

In addition to saving for homes, millennials love travelling, they have the lowest credit scores of any generation with 23% of them falling behind on their credit card repayments, and 84% of older millennials already own a car. NerdWallet and Money Supermarket are garnering engagement because they are speaking the language of millennials and offering services linked to the generation’s practical needs.

You should also get a good idea for how your target audience feels about their money. For example, 52% of millennial women agree that money is the biggest stressor in their lives and 55% feel overwhelmed when they think about money.

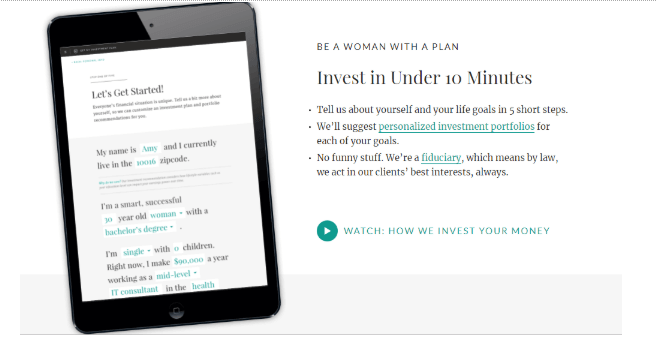

Ellevest’s marketing is centred on simplifying investment and wealth management for women and the brand is garnering engagement and loyalty by tapping into women’s emotions.

Besides emotions, Ellevest has been able to market to one of millennials’ top priorities – convenience. Between fast food, real-time Google updates, and personalised news feeds, millennials have come to expect efficiency and convenience from businesses. By helping women conquer their financial concerns in a timely fashion, Ellevest’s marketing is winning on two fronts.

3: Think Disruption

Millennials are not as risk-averse as you may expect. They have a surprisingly high tolerance for riskier financial activities and 40% of them are willing to take some form of risk with their finances. Over 70% of millennials believe that technical innovations like blockchain, which are perceived by many to be risky, increase the security of global financial systems.

There has also been an increase in the number of challenger banks that are focused on digital-savvy millennials. 1 in 4 millennials already use a challenger bank and these banks are picking up market share.

Revolut, a leading challenger bank, has introduced a commission-free trading app that allows trading straight from NASDAQ and NYSE. Revolut is trying to make investing more appealing to millennials because 65% of older millennials are intimidated by investing in the stock market and 42% of millennials invest conservatively compared to 23% of Baby Boomers and 38% of Generation X investors.

Disruptive innovations like the app are a contributing factor to the growth of Revolut which has attained seven million customers in a little over four years and is signing up about 10,000 new customers each day. Simply put, millennials relish disruption.

Top Marketing Tips

To create marketing campaigns with an edge you have to become a disruptor yourself. Being a disruptor is not only about creating the next asset class or launching the next disruptor bank; it’s about asking yourself how you can make the lives of millennials easier and adapting to their needs. Marketing campaigns need to show how you can help millennials manage their finances, using the tools and technologies they like.

It’s not just fintech start-ups and disruptor banks that are challenging the status quo of the finance sector. Tech companies like Google, Amazon and Facebook are also doing it. Just look at Facebook Messenger Payments and Amazon’s financial services ecosystem. Amazon is creating effective marketing campaigns with an emphasis on how millennials love disruption.

You can be a disruptor and create good marketing campaigns. For instance, 81% of millennials want brands to declare their social responsibility and 73% of them will buy from responsible brands. Therefore, you can create campaigns that show how you are providing the best fees and digital experiences without sacrificing ethics and transparency.

Triodos Bank is embracing ethical finance and social responsibility with its sustainable business financing campaign which has increased the bank’s loan portfolio by 10%. The campaign is increasing the bank’s reach because customers, especially millennials, are interested in initiatives that are for the greater good.

The campaign has been a hit because:

- It has roped in millennials who are passionate about social causes and give nearly $600 to charitable causes annually.

- It’s building trust. Besides its reputation for offering total transparency to investors and savers, Triodos bank is showing interest in sustainability, something that over a third of consumers are interested in.

- It’s increasing brand authority through consistency. Even as the bank takes up more technologies and consumer demands, it has remained true to its roots as one of the most ethical banks.

Combining your provision of the best service and experiences with technology such as AI will also strengthen your marketing campaigns. Millennials stand out for their love of technology but many people misconstrue this love to mean that millennials want technology everywhere for no particular reason. What millennials love about technology is the speed and convenience it provides.

For instance, 77% of consumers use AI-powered services and technologies that increase efficiency by 40% and 38% of consumers believe that AI will improve customer service.

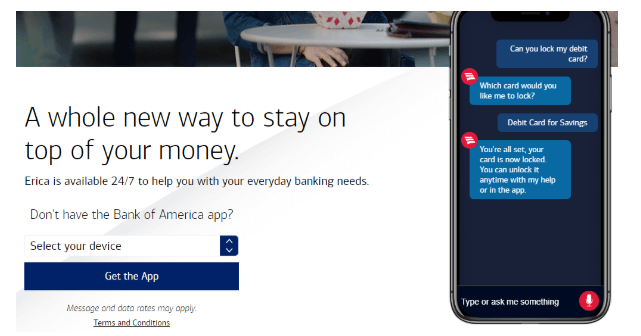

Using technology to interact with your customers in real-time and making interactions with your brand more efficient will boost your disruption efforts. 78% of millennials prefer to monitor their finances on mobile phones and Bank of America is using AI to help people get their financial information and monitor their accounts without having to visit the bank. Erica, the bank’s AI virtual assistant has already completed over 35 million client requests and now has over six million users.

Millennials are not a homogeneous group and they have tastes and preferences that keep morphing as they age. Remember when Instagram was just for teenagers? Those teenagers grew with the platform. Partner with financial services marketing experts like Contentworks for innovative analysis, blogging and social media solutions.

PS- Attending the Financial Innovation Forum on October 10-11? Catch up with the Contentworks Agency team to talk financial services marketing.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.