Natural Gas Prices Remain Under Pressure and Could Reach 2016 Lows – Guest Editorial

ATFX Chief Market Strategist Alejandro Zambrano looks at natural gas prices, concentrating on supply and demand over recent months.

Written by Alejandro Zambrano, Chief Market Strategist, ATFX.

Since November 2019, natural gas prices have been under pressure and have declined by 34.83%. The main reason for prices trading lower is that the market suffers from oversupply.

Since crude oil producers started to use fracking to extract crude oil from places that before were not profitable, they have also been finding natural gas as a by-product. However, they are not interested in natural gas, and sometimes, producers have found it cheaper to burn the gas instead of selling it, as they need to pay to get the gas to the market.

The problem with oversupply is not only a US problem; it is a global issue with oversupply in Europe and Asia.

Mild temperatures this winter have also pressured the price since November 2019, while the coronavirus outbreak also affected the demand for natural gas. The downward momentum accelerated after the price pierced below the 100-day moving average in December, while the coronavirus impact was felt in the natural gas markets after January.

However, in the last few days, natural gas prices managed to bounce after the Fed cut interest rates. The markets are currently pricing in more central bank rate cuts, and natural gas prices turned higher as the interest rate cuts might support the natural gas demand.

Natural Gas Price Technical Outlook

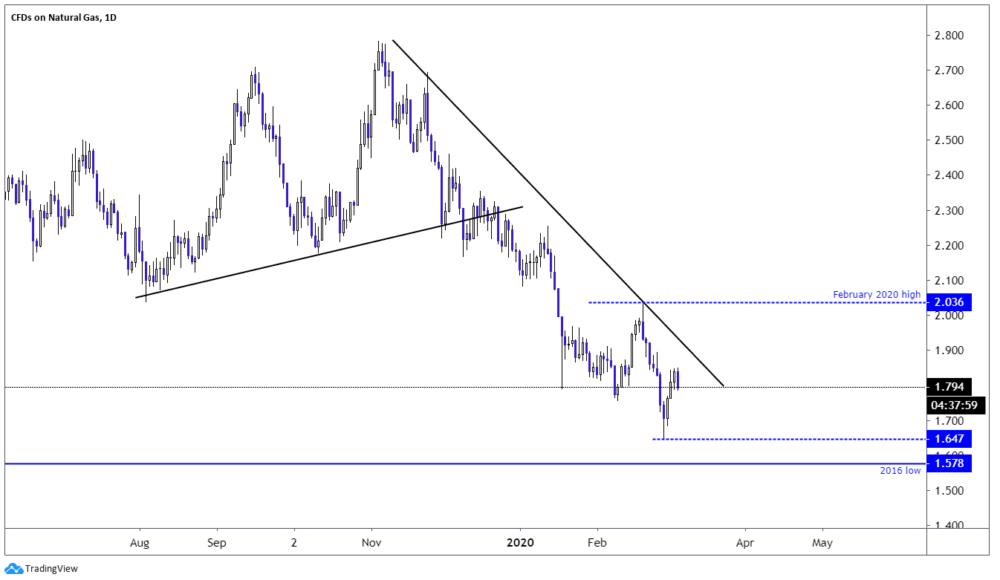

The technical outlook is bearish, and the price is trading below a descending trendline that started last November. The first signs of the market price turning higher would be if the index trades above the falling trendline. However, to indeed turn bullish, the price needs to take out the February 2020 high of 2.036, as long as the price remains in a downtrend, the price might be able to reach the 2020 low of 1.6747, followed by the 2016 low of 1.578.

Daily Chart

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.